China overtook Japan as the world’s largest auto exporter for the first time in 2023

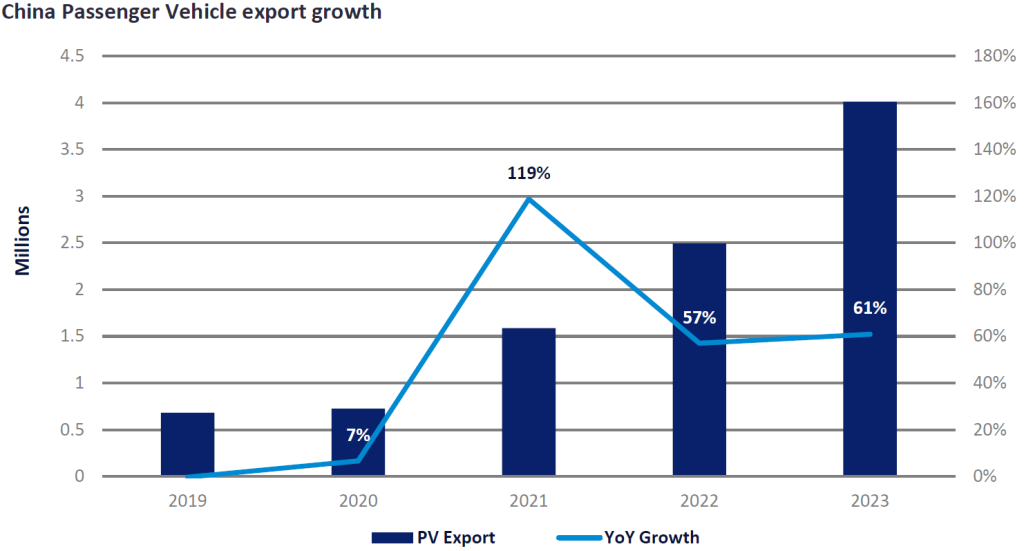

China’s Passenger Vehicle (PV) exports maintained a volume of around 700k units per year before 2020. However, in 2021, exports suddenly entered a period of explosive growth; PV export volume reached almost 1.59 million units, a 119% year-on-year (YoY) growth rate. In fact, as early as 2019, the global supply chain was already showing signs of facing various challenges and global auto production suffered a 6% YoY decline with this number rising to an 18% decline in 2021 versus 2018.

Relying on the vigorous development of the New Energy Vehicle (NEV) sector, good economic resilience and a stable supply chain, Chinese OEMs overcame many challenges during the years 2019 and 2020, recovering faster than the rest of the world and ushering in the export boom in 2021. In 2022, China’s Passenger Vehicle export volume reached 2.49 million units, a 57% YoY growth rate, to become the second largest exporter in the world. In 2023, Passenger Vehicle export volume exceeded 4 million units, achieving 61% YoY growth. Also, in 2023, China’s auto exports surpassed Japan’s enabling it to become the world’s largest exporter for the first time.

The high growth of China’s exports is composed of two parts: Chinese brands and foreign brands. For Chinese brands, the development of electrified vehicles and intelligent applications, as well as the improvement of product quality after verification in the Chinese market, has led to overseas expansion of Chinese brands as they are recognised and accepted by more consumers from different markets. In addition, for foreign brands like Tesla, efficient and high-quality production with a stable supply chain has ensured cost-effective production capacity for its expansion into international markets.

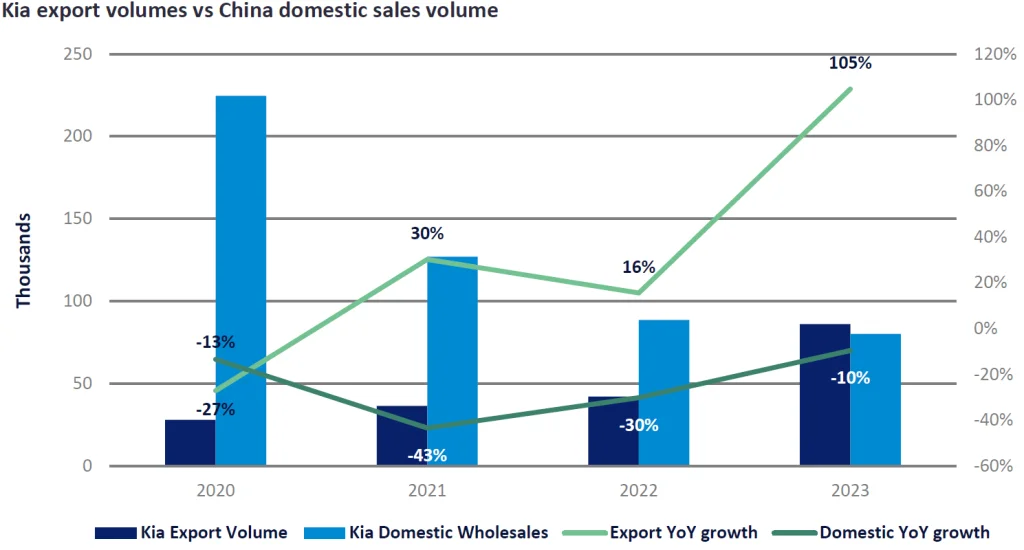

Efficient production capacity and growing exports have also brought new opportunities to Japanese and Korean brands. As the product strength of Chinese brands continues to improve, Japanese and Korean brands’ market share of the Chinese domestic market has declined significantly. Hence, Kia is utilising its existing Chinese production capacity to help supply its global market demand. As we can see from the chart below, Kia’s export volume first exceeded its Chinese market domestic sales in 2023. In January 2024, Kia exported over 9k units, achieving 178% YoY growth.

In 2024, Kia plans to continue increasing exports, and the destination markets will increase from the current fifty to more than eighty countries. Also, the company plans to change its Yancheng factory into Kia’s global export base and expand the scale of annual exports to more than 200k units by 2026. Nissan has also stated that it will start to rely on China’s complete industrial chain as an export base to cope with overcapacity for Internal Combustion Engine (ICE) vehicles and to supply global demand.

In the future, we believe that growth in China’s automotive exports will be a win-win situation for both Chinese and foreign brands. With healthy competition, both Chinese OEMs and those from other countries will usher in new developments.

Kevin Zeng, Light Vehicle Market Analyst, GlobalData

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center. For more details on GlobalData’s designated Global Light Vehicle Sales Forecast module, click here

Source from Just Auto

Disclaimer: The information set forth above is provided by just-auto.com independently of Chovm.com. Chovm.com makes no representation and warranties as to the quality and reliability of the seller and products.