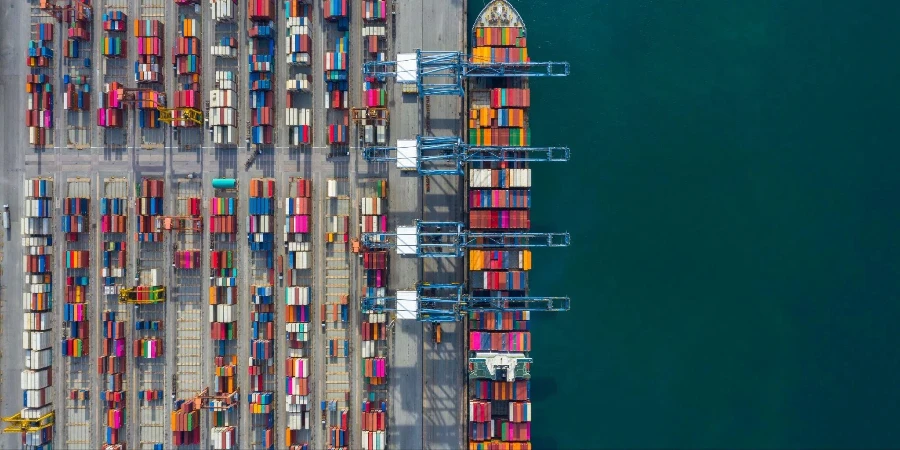

Ocean freight market update

China-North America

- Rate changes: Ocean freight rates on China to North America routes have seen a significant rise. Rates to the US West Coast surged by about a third compared to last month, while those to the East Coast saw nearly a 20% increase. This upward trend is attributed to early peak season demand and ongoing capacity constraints due to vessel diversions.

- Market changes: Market dynamics in the China-North America trade lane continue to evolve with increased demand pushing rates higher. The National Retail Federation projects US monthly ocean imports to surpass the two million TEU mark in May, indicating an early start to the peak season. Additionally, carriers are implementing new General Rate Increases (GRIs) and peak season surcharges, potentially driving rates up further. Labor negotiations on the East Coast and Gulf ports also pose a risk of disruptions, prompting shippers to expedite shipments.

China-Europe

- Rate changes: Rates on the China to North Europe and Mediterranean lanes increased by around 20% following early month GRIs. Despite this, rates are expected to continue climbing due to sustained demand and reduced capacity caused by vessel diversions around the Cape of Good Hope.

- Market changes: The China-Europe trade lane is experiencing unusual demand increases during what is typically a slow season. This surge has led to full ships and rolled containers, with European importers beginning a restocking cycle. Capacity remains tight due to the diversion of vessels away from the Red Sea, pushing carriers to announce additional GRIs. Despite the influx of new ultra-large container vessels, the market is struggling to meet the current demand, leading to further rate increases.

Air freight/Express market update

China-US and Europe

- Rate changes: Air freight rates from China to North America increased by approximately 8%, continued to be driven by the surge in B2C e-commerce shipments. Conversely, rates to North Europe declined by around 12%, reflecting varied demand conditions across regions.

- Market changes: The air freight market faces ongoing challenges with overcapacity and fluctuating demand. The recent increases in air cargo rates out of China have been primarily fueled by e-commerce. However, platforms like Temu are shifting focus from the US to Europe due to legislative pressures, which could alter capacity dynamics.

Additionally, the impact of public holidays like China’s Labor Day and Japan’s Golden Week caused significant drops in global tonnage, particularly from the Asia Pacific region. Despite these fluctuations, strong demand from the Middle East and South Asia to Europe has kept rates elevated. The ongoing disruption in ocean shipping and the demand for cross-border e-commerce are expected to maintain pressure on air freight capacity and rates through the upcoming months.

Disclaimer: All information and views in this post are provided for reference purposes only and do not constitute any investment or purchase advice. The information quoted in this report is from public market documents and may be subject to change. Chovm.com makes no warranties or guarantees for the accuracy or integrity of the information above.

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Chovm.com Logistics Marketplace today.