Catalina Energy Capital sê dit is nou op koers om teen die einde van 4 advies te gee oor meer as 2024 GW se sonkrag- en bergingsbates.

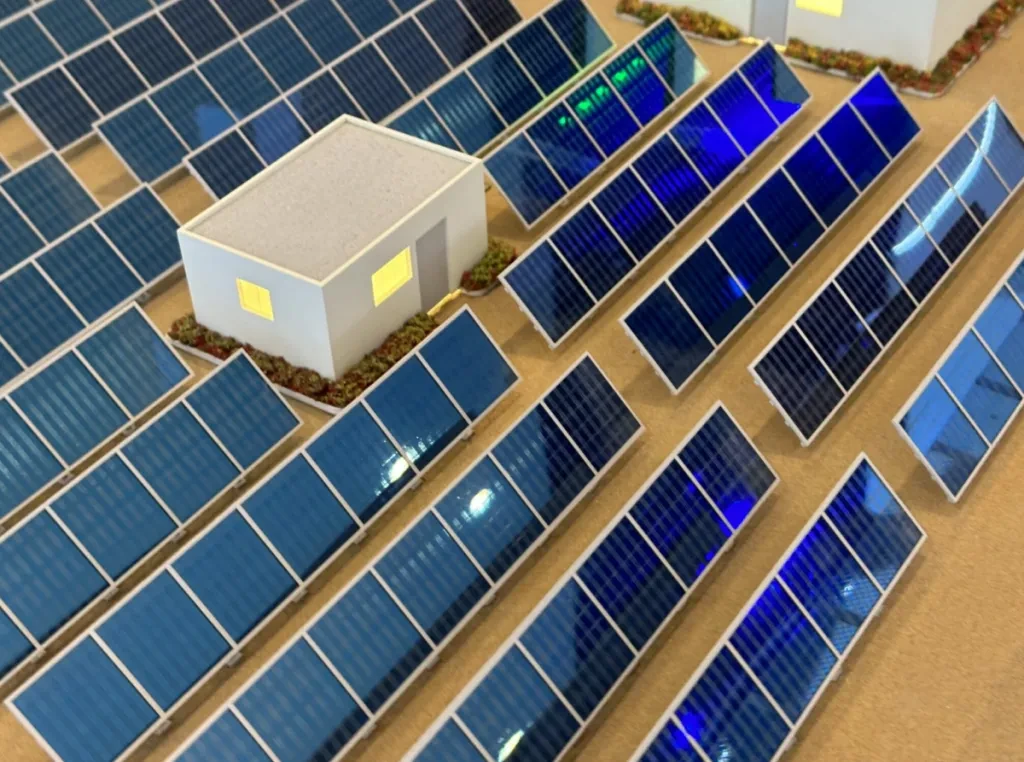

Beeld: pv tydskrif

Van pv tydskrif USA

Catalina Energy Capital is a renewable energy investment bank with a mission to accelerate the energy transition by creating capital solutions across debt and equity capital markets, mergers and acquisitions, climate tech, power purchase agreements, and tax credits.

Dan Rittenhouse, who founded the bank in July 2023, told pv magazine USA that the company raises capital at the corporate and project levels, spanning early-, mid-, and late-stage renewable energy assets.

The bank has already closed three deals. One of them is with SolarStone Ltd., which the bank advised on a solar and storage portfolio sale totaling 500 MW.

The bank has also arranged a $130 million corporate raise for Novel Energy Solutions, a Midwest-based solar and storage developer, from a $40 billion global asset manager.

A seven-figure equity and debt raise was also completed for Solar Collective, a commercial and industrial solar developer, from family office Current Equity Partners.

To continue reading, please visit our pv magazine USA webwerf.

Hierdie inhoud word deur kopiereg beskerm en mag nie hergebruik word nie. As jy met ons wil saamwerk en van ons inhoud wil hergebruik, kontak asseblief: editors@pv-magazine.com.

Bron van pv tydskrif

Vrywaring: Die inligting hierbo uiteengesit word verskaf deur pv-magazine.com onafhanklik van Chovm.com. Chovm.com maak geen voorstelling en waarborge oor die kwaliteit en betroubaarheid van die verkoper en produkte nie. Chovm.com ontken uitdruklik enige aanspreeklikheid vir oortredings met betrekking tot die kopiereg van inhoud.