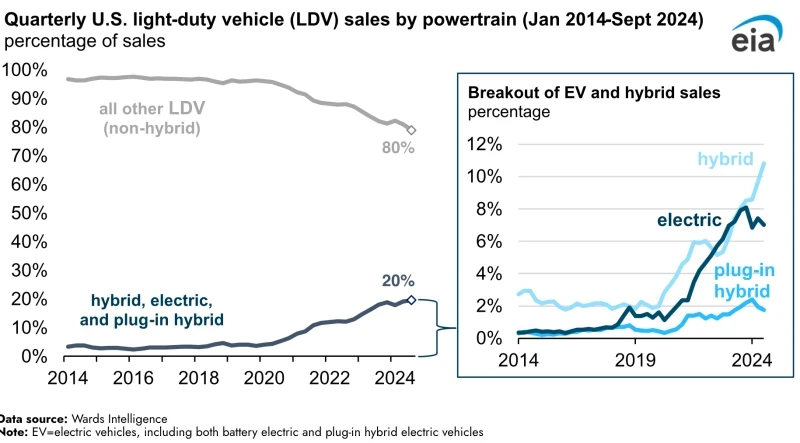

米国エネルギー情報局(EIA)は、米国における電気自動車とハイブリッド車の販売シェアが2024年第3四半期(24Q19.1)に再び増加し、過去最高に達したと報告している。Wards Intelligenceの推定によると、ハイブリッド車、プラグインハイブリッド電気自動車、バッテリー電気自動車(BEV)の合計販売台数は、米国の新車軽量車両(LDV)販売台数全体の2年第24四半期の19.6%から3年第24四半期にはXNUMX%に増加した。

電気自動車とハイブリッド車の市場シェアのこの増加は、主にハイブリッド電気自動車の販売によって推進されました。BEVの販売は減少し、そのシェアは7.4年第2四半期の米国LDV市場の24%から7.0年第3四半期には24%に低下しました。ハイブリッド車の販売シェアは増加し、ハイブリッド車は10.8年第3四半期に米国LDV市場の24%を占め、過去最高を記録しました。

BEVは高級車セグメントで引き続き人気があり、35.8年第3四半期の米国LDV高級車販売の24%を占めました。しかし、高級車市場以外での販売が増加したため、BEV総販売に占める高級BEVの割合は減少しており、2年第17四半期以来の最低シェアに落ち込んでいます。

それでも、70.7年第3四半期に米国で販売されたBEVの24%は高級車で、販売されたハイブリッド車は10.3%が高級車だった。Cox Automotiveによると、消費者や政府のインセンティブを考慮する前の新車BEVの平均取引価格は、56,351年第3四半期末時点で24ドルで、業界全体の平均価格より約16%高かった。

テスラは依然として米国のBEV市場で首位の座を維持しているが、市場シェアは48.8%で、今年50四半期連続で3%を下回った。テスラのモデルYとモデル3は引き続き売上を牽引しており、最近発売されたテスラ サイバートラックは、24年第1四半期のテスラの売上増加の原動力となり、すべての大型トラック競合製品(リビアンR1S、リビアンR150T、フォードFXNUMXライトニング、シボレー シルバラードEV、ハマーEV、GMCシエラEV)を上回った。

フォードは引き続きBEV市場で第6.9位のシェアを維持しているが、そのシェアは3年第24四半期の7.94%から2年第24四半期には3%に縮小した。新発売のエクイノックスモデルの販売とブレイザーモデルの継続的な成功により、販売はシボレーなどの他のメーカーに移行した。シボレーは24年第5.8四半期にヒュンダイに代わり、BEV市場で第XNUMX位のシェアを持つメーカーとなり、売上高はXNUMX%となった。

EVメーカーは国内外で車両を生産しています。Wards Intelligenceの推定によると、78.9年第3四半期に米国で販売されたBEV総数の24%は北米で生産され、7.3%は韓国で、5.3%はドイツで生産されました。

インフレ抑制法のクリーン車両税額控除の対象となるには、メーカーは最終組み立て、バッテリー部品、および重要な鉱物投入に関する国内コンテンツ要件を遵守する必要があります。この要件は、北米での製造だけにとどまりません。したがって、北米で製造されたと分類されるすべての車両がこの控除の対象となるわけではありません。これらの要件は、EV の購入に適用されますが、EV のリースにはそれほど厳しくありません。クリーン車両税額控除のインセンティブの対象とならない多くの EV 購入は、商用クリーン車両税額控除でリースされた場合に税額控除の対象となり、消費者はより幅広い適格な EV モデルを利用できるようになります。

ソースから グリーンカー会議

免責事項: 上記の情報は、Chovm.com とは独立して greencarcongress.com によって提供されています。Chovm.com は、販売者および製品の品質と信頼性について一切の表明および保証を行いません。Chovm.com は、コンテンツの著作権に関する違反に対する一切の責任を明示的に否認します。