새로운 주간 업데이트에서 pv 잡지다우존스 산하 기업인 OPIS는 글로벌 PV 산업의 주요 가격 동향을 간략하게 보여줍니다.

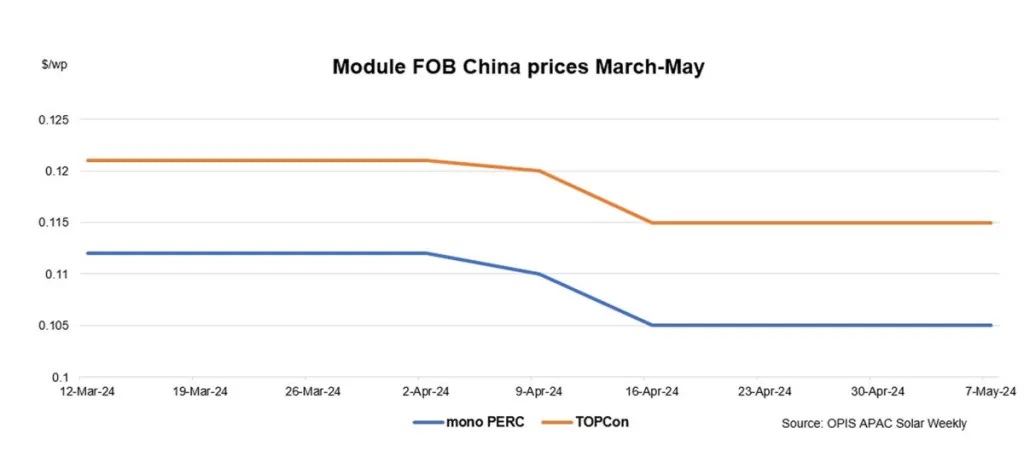

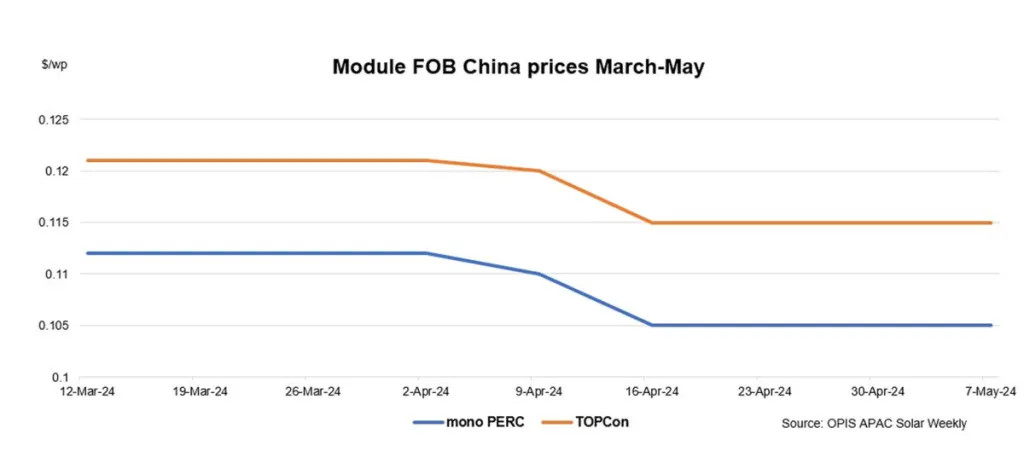

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China and mono PERC module prices held steady at $0.115 per W and $0.105/W, respectively.

Market activity in the Chinese market has yet to pick up although Chinese solar companies have returned after the Labour Day holidays. Trading remained subdued with few buyers in the market and these buyers were mostly bargain hunting, a market source said.

Demand remained weak as upstream prices across the solar value chain had previously extended losses before the Labour Day holidays. Although upstream prices held steady this week in a quiet market, market sources expect prices to fall in the coming days as trading activity resumes.

Module prices are expected to continue a downtrend amid weakness in the upstream sector, concurred many during OPIS’ weekly market survey. However, other market participants pointed out that module prices have already fallen below the cost of production which stands at about $0.126/W, and there is no longer any room for further price declines.

There is the expectation that mono PERC prices will continue to hold steady as supply will gradually tighten with demand shifting towards TOPCon modules. The limited availability of mono PERC modules could result in mono PERC prices trading higher, a market veteran said.

Module manufacturers may reduce their operating rates in May to mitigate falling prices and restore the supply/demand balance in the market. Previously in April, the operating rates of module manufacturers were between 70% and 100%.

The global solar cell and module manufacturing industry is currently operating at a utilization rate of approximately 50%, according to the EIA.

Trading activity for Southeast Asian modules has been limited as uncertainty persists regarding antidumping/countervailing duties (AD/CVD). Buyers are adopting a wait-and-see approach regarding policy development and there are relatively few new contracts signed recently, a Southeast Asian module producer said.

Another market participant noted that module prices will likely rise in anticipation of the potential duties. Nonetheless, these anticipated price increases have yet to impact the market as buyers remain hesitant to secure new contracts due to high inventory levels in the United States.

다우존스 계열사인 OPIS는 가솔린, 디젤, 제트 연료, LPG/NGL, 석탄, 금속, 화학 물질, 재생 연료 및 환경 상품에 대한 에너지 가격, 뉴스, 데이터 및 분석을 제공합니다. 2022년에 싱가포르 태양광 거래소에서 가격 데이터 자산을 인수했으며 현재 OPIS APAC 태양광 주간 보고서를 발행하고 있습니다.

이 기사에 표현 된 견해와 의견은 저자 자신의 것이며, pv 잡지.

이 콘텐츠는 저작권으로 보호되며 재사용할 수 없습니다. 저희와 협력하고 저희 콘텐츠 중 일부를 재사용하고 싶으시다면 editors@pv-magazine.com으로 연락해 주세요.

출처 pv 잡지

면책 조항: 위에 제시된 정보는 Chovm.com과 독립적으로 pv-magazine.com에서 제공합니다. Chovm.com은 판매자와 제품의 품질과 신뢰성에 대해 어떠한 진술이나 보증도 하지 않습니다.