America flexes its ‘industrial muscle’ confirming financial support to onshore solar supply chain

کلیدي ټکي

- US Treasury Department’s final rules on Section 45X provide investment certainty to the solar PV manufacturing industry

- Incentives remain unchanged from the previous guidance released in December 2023

- This includes incentives for solar modules, cells, wafers, solar-grade polysilicon, torque tubes, structural fasteners, polymeric backsheets, and even solar trackers

The US Department of the Treasury has released the final rules for the Advanced Manufacturing Production Tax Credit under Section 45X of the Internal Revenue Code, a tool for the administration under the Inflation Reduction Act (IRA) to spur clean energy manufacturing in the country.

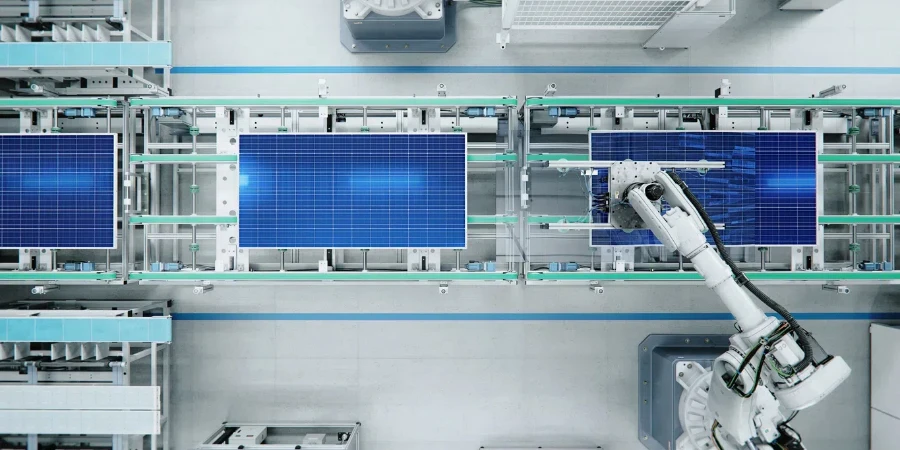

Section 45X provides incentives for manufacturers of solar and energy storage systems across the supply chain. Solar Energy Industries Association (SEIA) says that since the tax credit is tied to the production volume, it provides long-term support for manufacturers once a facility is online.

It defines and confirms the credit amounts for eligible components, including solar modules, cells, wafers, solar-grade polysilicon, torque tubes, structural fasteners, polymeric backsheets, and even solar trackers.

د وروستي قوانین are largely in line with the guidance it issued in December 2023. These reiterate the previously announced credit limits of $0.07/W for solar modules, $0.40/m2 for polymeric backsheets, $3.00/kg for solar-grade polysilicons, $0.87/kg for torque tubes, $12.00/m2 for PV wafers, $2.28/kg for structural fasteners (see US Guidance On Clean Energy Manufacturing Credits).

SEIA President and CEO Abigail Ross Hopper called Section 45X one of the most influential policies in the US to onshore the solar supply chain. This clarity, she explained, will provide certainty to the domestic solar and storage manufacturers for their investments.

The Executive Director of Solar Energy Manufacturers for America (SEMA) Coalition, Mike Carr welcomed the move saying, “The 45X credit is the foundation for reshoring the solar supply chain and has already changed the face of the US solar manufacturing industry. Issuing this final rule takes a critical step forward in providing certainty for investments to build new and restart mothballed solar factories.”

Since the IRA was passed in August 2022, the Advanced Manufacturing Production Credit has mobilized more than $126 billion in private sector announcements for clean technology manufacturing. These include $77 billion for batteries, $6 billion for critical materials, $19 billion for solar, and $8 billion for wind, according to the department that cites this data from the Rhodium Group/MIT’s Clean Investment Monitor (CIM).

“For too long, technologies invented in America were manufactured somewhere else. Not anymore. President Biden and Vice President Harris are finally bringing that manufacturing home,” said White House National Climate Advisor Ali Zaidi. “We are flexing America’s industrial muscle.”

Recently, the Treasury Department expanded the ambit of its lucrative CHIPS & Science Act to include solar ingot and wafer production in the final rules released (see US Announces Tax Credits For Ingots & Wafers Under CHIPS & Science Act).

د سرچینې څخه د تای یانګ خبرونه

رد کول: پورته ذکر شوي معلومات د تای یانګ نیوز لخوا د Chovm.com څخه په خپلواکه توګه چمتو شوي دي. Chovm.com د پلورونکي او محصولاتو کیفیت او اعتبار په اړه هیڅ استازیتوب او تضمین نه کوي. Chovm.com په څرګنده توګه د محتوا د کاپي حق پورې اړوند سرغړونو لپاره هر ډول مسؤلیت ردوي.