د pvXchange.com بنسټ ایښودونکی، مارټین شاچینګر وايي چې د نومبر په میاشت کې د لمریز ماډلونو لپاره د بیې ۸٪ کمښت ممکن د دوامداره کمښت پای ته ورسیږي، ځکه چې د بازار نښې نښانې د احتمالي بیا رغونې ته اشاره کوي.

Image: Martin Schachinger, pvXchange.com

د جرمني د pv مجلې څخه

The sharp price drop for solar modules in November might mark the end of the ongoing decline, as the market shows signs of recovery.

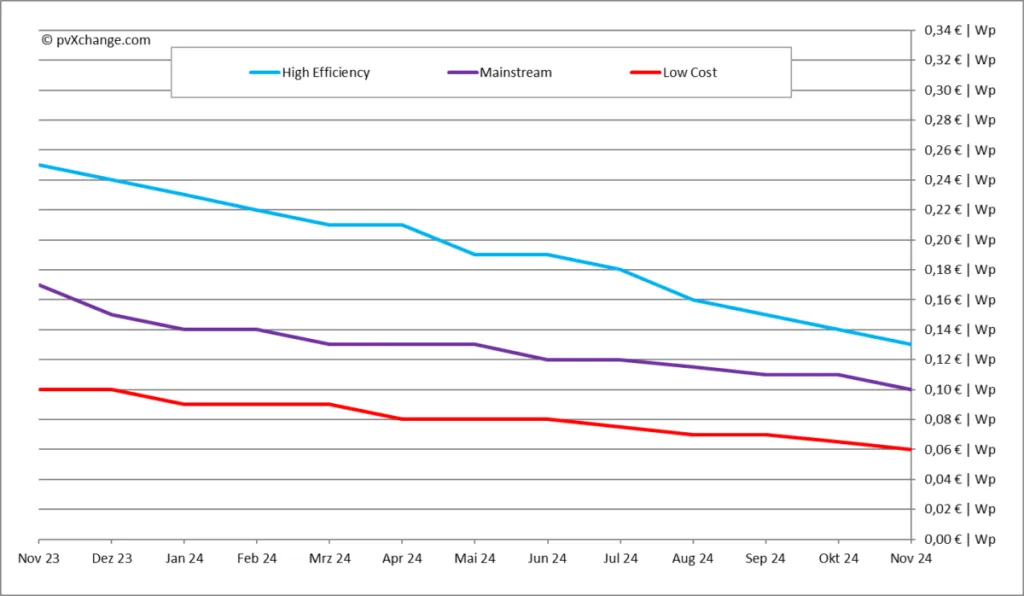

Prices fell by an average of 8% across all technologies, squeezing margins even on recently purchased modules. This drop resulted from moderate demand, year-end stock clearance campaigns, and insolvency-related emergency sales.

Some modules are now selling for under $0.06/W, but experts warn against low-quality, no-name products, citing operational risks and unreliable guarantees from second- or third-tier Chinese manufacturers.

The downward trend appears to be reversing. China’s export tax rebate on solar modules, long set at 13%, dropped to 9% on Dec. 1, raising exporters’ costs by 4%. This change could increase module prices by $0.03/W to $0.05/W.

More significantly, manufacturers are reducing production to engineer an artificial supply shortage. Capacity cuts in China, reduced exports, and factory shutdowns over the winter aim to restore profitability. This strategy, if effective, could transform the market into a seller’s market where suppliers dictate prices.

How quickly this strategy succeeds depends on the volume of existing stock in Europe. Adequate supply could limit the impact of production cuts, particularly for mainstream modules. Premium products, such as bifacial glass-glass modules with high efficiency, may see sharper price increases, widening the gap between mainstream and high-efficiency offerings. Budget modules may still be available at bargain prices.

Market players are acting cautiously, with some reversing cancellations for surplus goods and securing inventory. Projects with solid pipelines are hedging against future shortages by purchasing now. If an end-of-year rush depletes stocks, it could trigger the price increases suppliers anticipate – even modest stimuli like minor tax changes could drive such a shift.

د لیکوال په اړه: مارټین شاچینګر has studied electrical engineering and has been active in the field of photovoltaics and renewable energy for almost 30 years. In 2004, he set up the pvXchange.com online trading platform. The company stocks standard components for new installations and solar modules and inverters that are no longer being produced.

په دې مقاله کې څرګند شوي نظرونه او نظرونه د لیکوال خپل دي، او ضروري نه ده چې د هغه نظرونه منعکس کړي چې د pv مجله.

دا مواد د کاپي حق لخوا خوندي دي او بیا کارول کیدی نشي. که تاسو غواړئ زموږ سره همکاري وکړئ او غواړئ زموږ ځینې مواد بیا وکاروئ، مهرباني وکړئ اړیکه ونیسئ: editors@pv-magazine.com.

د سرچینې څخه pv مجله

رد کول: پورته ذکر شوي معلومات د pv-magazine.com لخوا د Chovm.com څخه په خپلواکه توګه چمتو شوي دي. Chovm.com د پلورونکي او محصولاتو کیفیت او اعتبار په اړه هیڅ استازیتوب او تضمین نه کوي. Chovm.com په څرګنده توګه د محتوا د کاپي حق پورې اړوند هر ډول سرغړونو لپاره مسؤلیت ردوي.