Key Takeaways

Small businesses are feeling the brunt of the energy crisis

Some respite for businesses expected with the introduction of the Energy Bill Relief Scheme

The energy crisis is causing rapid cost-push inflation in the UK economy

The ongoing energy crisis has caused energy bills to spiral. Following a 54% increase in energy prices in April 2022 and a rise in the price cap to £2,500 included in the Energy Price Guarantee in October 2022, consumers have been forced to cut down on their electricity consumption to save on household bills.

While consumers have benefitted from a £400 energy bill discount from October to March 2023, further energy cost inflation is expected in April 2023.

This is because Ofgem is due to remove the Energy Price Guarantee, meaning annual bills for a household with typical consumption at around £2,500 will likely rise.

Providers such as Octopus Energy and OVO are paying customers to reduce usage to avoid electricity shortages and blackouts.

Suppliers have struggled to remain profitable and between November 2021 and November 2022, 16 energy suppliers have exited the market, which has affected approximately 1.75 million domestic consumers and 231,800 non-domestic consumers, according to Ofgem, altering the market structure of the energy sector.

Moreover, the security of gas and electricity supply has come under threat, especially given the reduction of gas deliveries from Nord Stream 1, which shut entirely in August 2022 and has not opened since, amid the ongoing Russia-Ukraine conflict.

Effect on the UK economy and consumers

While consumers have benefitted from a price cap, UK businesses have not. The Federation of Small Businesses estimates that between February 2021 and August 2022, electricity bills have risen by 349% and gas bills by 424%. It reports that 53% of firms expect to collapse, shrink or, at best, stagnate over the next year.

The Energy Bill Relief Scheme will provide some respite for businesses between 1 October 2022 and 31 March 2023, with the government support price set at £211 per megawatt-hour (MWh) for electricity and £75 per MWh for gas.

The Energy Price Guarantee of £2,500 has been reduced to 6 months and will end in April 2023.

According to market research company Cornwall Insight, annual bills could equate to £4,347.69 from April to June 2023, with gas at £2,286.70 and electricity at £2,060.99, representing a 74% increase.

To understand why energy bills are rising so rapidly, it is important to analyse the breakdown of UK energy bills. Energy bills include network costs, social and environmental obligation costs such as the implementation of smart meters, supplier operating costs, other direct costs such as meter maintenance, VAT and, most importantly, wholesale costs.

According to Ofgem, as of October 2022, wholesale costs make up 65.6% of the default tariff price cap compared with 51.3% in August 2022 and 30.5% in August 2021. The rising price of fossil fuels driving wholesale energy prices has caused the global energy crisis.

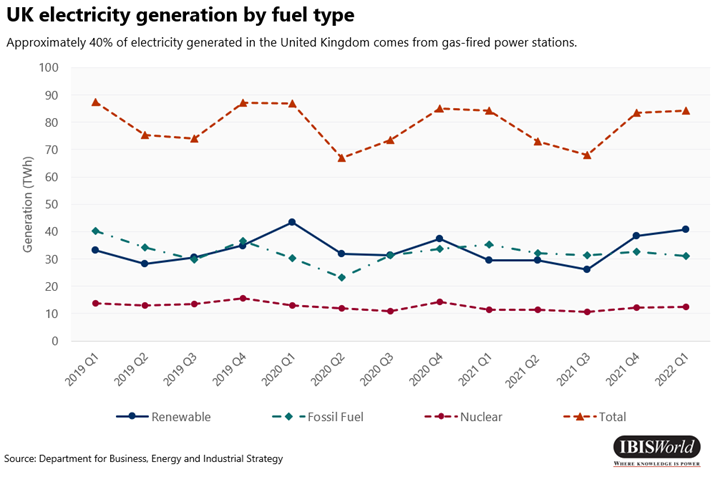

A restricted supply of electricity and natural gas from Europe is largely to blame for the surge in domestic wholesale prices since around 85% of households use gas boilers to heat homes, while approximately 40% of electricity generated in the UK comes from gas-fired power stations.

Crucially, the energy crisis is causing rapid cost-push inflation in the UK economy. As real household disposable incomes are expected to fall significantly over the current year, businesses unable to pass on costs will be forced to close.

In the short term, continued cost-push inflation will likely involve raising UK bank rates in April 2023, currently set at 3%, which will increase the cost of borrowing. In the longer term, the energy price guarantee and support for household energy bills could cost the UK taxpayer an estimated £60 billion.

Effect on companies and market structure

Traditionally, electricity retail has been dominated by six large energy firms, accounting for 99% of the domestic retail market in 2009. However, domestic and non-domestic markets have displayed significant changes in market share more recently, driven by high net entry and expansion of small and medium-size suppliers.

Soaring wholesale prices have forced several small and medium-size suppliers out of the market over the past two years.

According to Ofgem, the number of active domestic gas and electricity suppliers fell from 49 to 24 between March 2021 and March 2022.

Energy companies are also struggling with profitability; for instance, EDF Energy, one of the UK’s largest electricity suppliers, recorded a loss of £113 million for its supply segment in 2021.

With many energy suppliers struggling to remain profitable and subsequently exiting the industry, customer accounts of collapsed suppliers have transferred to larger firms through Ofgem’s Supplier of Last Resort (SoLR) process.

Bulb Energy entered energy supply company administration under a Special Administration Regime on 24 November 2021. Bulb served around 1.6 million domestic customers and 12,000 non-domestic customers.

Overall, since August 2021, more than 2.3 million domestic customers have been transferred from collapsed small and medium-size suppliers, including another 580,000 domestic customer accounts from Avro Energy to Octopus Energy.

These developments, caused by energy suppliers failing to make a profit under the UK energy price cap guarantee, have increased the market share concentration among EDF Energy, E. ON, Octopus energy, OVO energy group and British Gas through the SoLR process.

Conclusion

With the end of the energy price cap in April 2023, energy suppliers are expected to become more profitable, encouraging more entrants into the industry due to the short-term prospects of higher bill revenue and lower wholesale electricity prices. In the medium term, these small to medium-size suppliers will reduce the market share concentration within the energy sector.

By improving the energy efficiency of domestic homes in pursuit of net zero emissions by 2050 through smart meters and more effective insulation, the UK will reduce its reliance on non-renewable energy over the coming years.

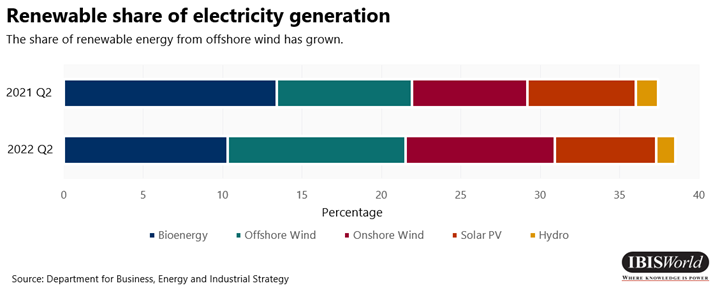

To increase energy security, the UK needs to increase the roll-out of renewable energy infrastructures, which will continue dramatically reducing the unit cost of renewable energy generation.

Diverting focus to a self-sufficient renewable energy supply, like offshore wind, will make the UK economy less susceptible to European energy supply shocks and surging wholesale electricity and gas prices.

Source from IBISWorld.

Disclaimer: The information set forth above is provided by IBISWorld independently of Chovm.com. Chovm.com makes no representation and warranties as to the quality and reliability of the seller and products.