I-United Kingdom (e-UK) imele imarike enengeniso yokungenisa uluhlu olubanzi lweemveliso, ukusuka kwizinto zodidi ukuya kwizinto zemihla ngemihla. Isiseko sabathengi bayo sinamandla amakhulu okuthenga, kunye nenkcitho yosetyenziso lwasekhaya ifikelela malunga USD 1.894 itriliyoni ngo-2022. Eli nani liphantse lalingana nayo yonke inkcitho yokusetyenziswa kwekhaya Afrika ngo-2021.

Ngapha koko, i-UK inenye yezona ntengiso ziphambili ze-e-commerce kwihlabathi, enenxalenye enkulu yabathengi Ukuthenga okwenzeka kwi-intanethi. Oku kwenza ukuba amashishini aphesheya athengise iimpahla ngaphandle kokuseka ubukho bomzimba e-UK. Ke ngoko, ayimangalisi into yokuba ixabiso lempahla epheleleyo engeniswe e-UK kwiinyanga ezili-12 ezikhokelela kuJanuwari ka-2024. I-USD 1.204 yezigidigidi.

Nangona kunjalo, inkqubo yokungenisa impahla e-UK ibandakanya imisebenzi emininzi enzima kunye namaxwebhu, ukusuka ekucwangcisweni nasekulungiseleleni ukuhanjiswa kwempahla ukulungiselela nokuhambisa amaxwebhu okuthumela ukuze ahlangabezane neemfuno ze-customs zase-UK.

Ngapha koko, ekubeni i-UK yagqiba ekubeni ishiye i-European Union, eyaziwa njenge Brexit, kuye kwaqaliswa ukuhlola izinto ezintsha, izivumelwano zorhwebo, nokwanda okuphawulekayo kwamaphepha afunekayo.

Kodwa akukho maxhala! Qhubeka ufunda njengoko sisenza lula yonke inkqubo yokungenisa iimpahla ukusuka e-China ukuya e-UK kule post yebhlog, iyahlulahlula ibe ngamanyathelo amahlanu nje alula!

Isiqulatho

1. Kutheni le nto amashishini kufuneka angenise iimpahla ezivela eTshayina?

2. Ngenisa iimpahla ezivela eChina ukuya e-UK ngamanyathelo ama-5

3. Yenza lula inkqubo yokungenisa e-UK kunye nee-customs brokers

Kutheni le nto amashishini kufuneka angenise iimpahla ezivela eTshayina?

Phambi kokuphonononga inkqubo enamanyathelo amahlanu okungenisa iimpahla e-China e-UK, umntu unokubuza, "Kutheni ukungenisa eTshayina kwasekuqaleni?" Apha ngezantsi zizizathu ezine ezenza iTshayina ibe ngumthombo onomtsalane weemveliso kwiinkampani zehlabathi:

Umthamo omkhulu wokuvelisa

Esona sizathu siphambili iTshayina igqalwa njengomthombo ofanelekileyo wamashishini afuna ukungenisa iimpahla kumazwe angaphandle kukuqwalaselwa kwayo “njengomzi-mveliso wehlabathi.” Ngo-2021, i-China imele 30% yemveliso yemveliso yehlabathi, kwaye eli nani liye lakhula laya kutsho I-USD 4.98 yezigidigidi kwi 2022.

Nangona iminyaka emininzi, "Yenziwe etshayina” ileyibhile idityaniswe nezinto eziveliswe ngobuninzi zomgangatho ophantsi nophantsi, isandul’ ukumela inguqulelo entsha, umgangatho, kunye nemveliso ekwinqanaba eliphezulu. Olu tshintsho lwenziwe lutyalo-mali olubalulekileyo olwenziwa ngurhulumente wase-China kumacandelo ezobuchwepheshe, kubandakanywa iirobhothi, i-aerospace, kunye nezithuthi zamandla acocekileyo.

Iindleko zomsebenzi eziphantsi

Ngokwembali, iindleko eziphantsi zabasebenzi e-China ibe yenye yezinto eziphambili ezitsala iinkampani zehlabathi ukuba zingafumani nje kuphela kwaye zingenise iimpahla ezivela kweli lizwe kodwa ziphinde zifuduse amaziko azo emveliso.

Ngelixa kuyinyani ukuba iindleko zabasebenzi eTshayina zinyukile kule minyaka imbalwa idlulileyo, zihlala zisezantsi kunamazwe amaninzi aseYurophu nakuMntla Melika. Imivuzo ephantsi ayithethi ukuba iimeko zokusebenza ezimbi zisoloko zinento yokwenza nokuhla kweendleko zokuphila. Ngokomzekelo, ukuhlala eTshayina 72% eshibhileyo kunaseUnited States.

Ukufikelela kwiiteknoloji ezivelayo

I-China iphinda iguqule indlela iimveliso eziyilwa ngayo kwaye ziveliswe. Icandelo lemveliso laseTshayina utyale imali kakhulu kwitekhnoloji ekrelekrele eyenza iifektri zibe nobukrelekrele ngakumbi kwaye ziqhagamshelene.

Ukongeza, iTshayina i Inkokeli yehlabathi ekuhanjisweni kweerobhothi kunye automation kwimveliso. Iifektri zaseTshayina ezihlakaniphile nazo zisebenzisa 3D yoshicilelo, ukuququzelela i-prototyping ekhawulezayo, ukusetyenziswa kakuhle kwezinto eziphathekayo, kunye nokudalwa kwezakhiwo ezinzima ezinokuthi iindlela zokuvelisa zendabuko azikwazi ukufikelela ngokulula.

Ezi nkqubela phambili zibonelela iinkampani zehlabathi ukufikelela kwiitekhnoloji ezintsha, ziqinisekisa ukuchaneka, isantya, kunye nempumelelo kwimigca yemveliso, ukusuka kubathengi be-elektroniki ukuya kwiimoto.

I-ikhosistim eyomeleleyo nedibeneyo

Ubume belizwe laseTshayina njengendawo ephambili yehlabathi kwimveliso kunye nokufunwa kwempahla ayibalelwanga nje kwizakhono zayo, abasebenzi abafikelelekayo okanye amandla ayo okuvelisa. Ikwangenxa yenkqubo ephuhliswe kakuhle yoshishino lwendalo elizweni. Oku kuquka uthungelwano olomeleleyo lwababoneleli, abavelisi, kunye neenkampani zolungiselelo.

Ukongeza, iChina idume ngokuba yiyo amaqela emizi-mveliso, ezizizithili ezigxininiswe ngokwejografi zeenkampani ezinxibeleleneyo, ababoneleli abakhethekileyo, kunye nababoneleli ngeenkonzo. Uthungelwano olunjalo lwe-ecosystem luqinisekisa ukuba isigaba ngasinye sesixokelelwano semveliso, ukusuka ekufuneni imathiriyeli ekrwada ngokwenziwa kwemveliso ukuya ekuhanjisweni kokugqibela, silungiselelwe isantya kunye nokusebenza kakuhle kweendleko.

Ngenisa iimpahla ezivela e-China ukuya e-UK ngamanyathelo ama-5

Ngoku siyasiqonda isizathu sokuba iTshayina iliziko lokuya kwiziko lokuvelisa kunye nokukhangela iimpahla, makhe siphonononge ukuba amashishini anokuqalisa njani ukungenisa iimpahla ukusuka e-China ukuya e-UK ngamanyathelo amahlanu:

1. Phanda ngokuthotyelwa kweempahla ezivela kumazwe angaphandle

Xa ungenisa iimpahla ezivela e-China ukuya e-UK, inyathelo lokuqala libandakanya ukuqinisekisa ukuba iimveliso zihambelana nemigaqo kunye nemigangatho efanelekileyo yase-UK. Kwiimveliso ezininzi ezilungiselelwe ukuthengiswa eGreat Britain, iSebe lezoShishino noRhwebo (I-DBT) ifuna ukuba amashishini afumane esinye sezatifikethi ezibini eziphambili:

- UKCA (Ukuthobelana kwe-UK kuyavavanywa): Olu phawu lokuthotyelwa lubonisa ukuba imveliso iyahlangabezana neemfuno zolawulo ezithengiswayo ngaphakathi kweGreat Britain (eNgilani, eSkotlani, naseWales). Igubungela uninzi lwempahla, kubandakanya, kodwa ingaphelelanga apho, iithoyi, izinto zombane, kunye neemveliso zokwakha.

- Ukumakisha: le Ukuvumelana kweYurophu uphawu lubonisa ukuthotyelwa kwemveliso kuzo zonke iimfuno zolawulo ezisebenzayo zeManyano yaseYurophu (EU) ngokumalunga nempilo, ukhuseleko, kunye nokhuseleko lokusingqongileyo.

Ngelixa i-UK iya kuqhubeka nokuqaphela uphawu lwe-CE ngokungenasiphelo kwiimpahla ezininzi ezibekwe kwimarike eGreat Britain, ukumakishwa kwe-UKCA kuye kwanyanzeleka emva kweBrexit yeemveliso ezintsha ezingena kwimarike ye-GB okanye xa imigaqo ethile yase-UK yahlukile kwimigangatho ye-EU.

Kubalulekile ukuqaphela ukuba izatifikethi ezongezelelweyo, uhlolo lokhuseleko, okanye izibhengezo zokuthobela zingaba yimfuneko kwezinye iimveliso. Umzekelo, imvume evela kwi-Arhente yoLawulo lwaMayeza kunye nezeMpilo (MHRA) iyafuneka ukuze kungeniswe amayeza alungiselelwe ukusetyenziswa ngabantu okanye kunyango lwezilwanyana.

Ngaphaya koko, iimpahla ezithile zithintelwe okanye zithintelwe ngokupheleleyo ukuba zingangeniswa e-UK, nokuba zithathwe eTshayina okanye kwenye indawo. Umzekelo, ukungeniswa kwamanye amazwe amachiza alawulwayo, kubandakanywa i-narcotics kunye nezinto eziphazamisa ingqondo, akuvumelekanga phantsi komthetho wase-UK.

2. Fumana ubhaliso oluyimfuneko kunye nezazisi

Emva kokuba iinkampani zokurhweba ziqinisekisile ukuba iimpahla ezijoliswe ekungenisweni zithobela yonke imimiselo kunye nemigangatho yaseBrithani efunekayo, inyathelo elilandelayo kukubhalisa ukuchongwa okubalulekileyo okubini, njengoko kugunyaziswe yi-HM Revenue and Customs (I-HMRC):

2.1 Inani le-EORI

Amashishini kufuneka afumane uBhaliso lwe-Economic Operator kunye neSaziso (EORI) inani lokungenisa iimpahla e-UK. Esi sichongi sahlukileyo sabelwe zombini iinkampani kunye nabantu ababandakanyeka kurhwebo lwamazwe ngamazwe neYurophu, kuquka ne-UK, emva kweBrexit.

Bonke abarhwebi badinga inguqulelo yase-UK yale nombolo ukuhambisa iimpahla ngaphakathi okanye ngaphandle kweGreat Britain, Northern Ireland, okanye Isle of Man, kunye naphakathi kweGreat Britain namanye amazwe. Ukuba nenombolo ye-EORI iyimfuneko ekungeniseni izibhengezo zezithethe kunye nokufumana iimvume kugunyaziwe wezithethe zase-UK (HMRC).

2.2 IVAT (uyazikhethela)

Ukongeza, kunokuba luncedo kumashishini ukuba bhalisela i-VAT (I-Value Added Tax) ukuba banqwenela ukubanga kwakhona nayiphi na i-VAT ehlawulwe kwiimpahla ezingeniswa kumazwe angaphandle. Ngelixa ukubhaliswa kwe-VAT kungafuneki kubo bonke abarhwebi abavela kumazwe angaphandle, kunokubonelela ngeenzuzo zemali kwabo bathe gqolo bengenisa i-VAT kwizinto ezithengwayo.

Njengomzekelo, khawucinge ungenisa izixhobo zombane ezixabisa i-USD 100,000 e-UK, kwaye uhlawuliswa i-20% ye-VAT xa ungena. Oku kuthetha ukuba uya kuhlawula i-USD 20,000 kwi-VAT. Ukuba ubhalisele i-VAT, ungaphinda uyifumane le USD 20,000 ye-VAT kwi-VAT yakho ye-VAT, ngaphandle kokuba iimpahla zenzelwe ushishino.

3. Lungiselela indlela yokuthumela

Ngoku iinkampani zifumene izatifikethi eziyimfuneko zemveliso kwaye ziqinisekisa ukuba izazisi zeshishini labo zilungile, inyathelo elilandelayo libandakanya ukwenza isigqibo sokuba iimpahla ziya kubuyela njani e-UK ngokwasemzimbeni.

Ngokwesiqhelo, amashishini anokukhetha phakathi kokuthuthwa komoya okanye elwandle okanye akhethe ukudityaniswa kwezi ndlela neendlela zasekhaya okanye izisombululo zikaloliwe. unikezelo lwemayile yokugqibela ngaphakathi e-UK:

- Ukuthuthwa komoya: Olu lolona khetho lukhawulezayo lokuhambisa iimpahla phakathi kweTshayina ne-UK. Ifanelekile kwizinto ezingxamisekileyo okanye ezitshabalalayo, ziqinisekisa ukuba ziyafika kwindawo eziya kuyo ngexesha elifutshane. Ukurhweba kwesi santya yindleko ephezulu, okwenza kube yeyona ndlela ibiza kakhulu yothutho.

- Uthutho lwaselwandle: Olona khetho lungabizi kakhulu lokuthenga ngaphandle kwempahla enkulu, enkulu, okanye enzima evela eTshayina. Nangona le ndlela icotha kakhulu kunezothutho lomoya, ibonelela ngogcino olubalulekileyo lwempahla engakhathali ngexesha, iyenza ilungele umthamo omkhulu.

- Imultododal or uthutho phakathi kweendlela: Ezi ndlela zidibanisa iindlela ezahlukeneyo zothutho. Umzekelo, iimpahla zinokuthunyelwa ngenqanawa ngenqanawa ukuya kwizibuko lase-UK, emva koko ilandelwe nguloliwe okanye ngothutho lwendlela ukuya kwindawo yokugqibela. Le ndlela ichaphazela ulungelelwaniso phakathi kwexesha kunye neendleko, kuxhaphake ukusebenza kakuhle kweendleko zothutho lwaselwandle oludityaniswa nokuchaneka, unikezelo lwasekhaya olubonelelwa ngothungelwano lweendlela okanye iinkqubo zikaloliwe.

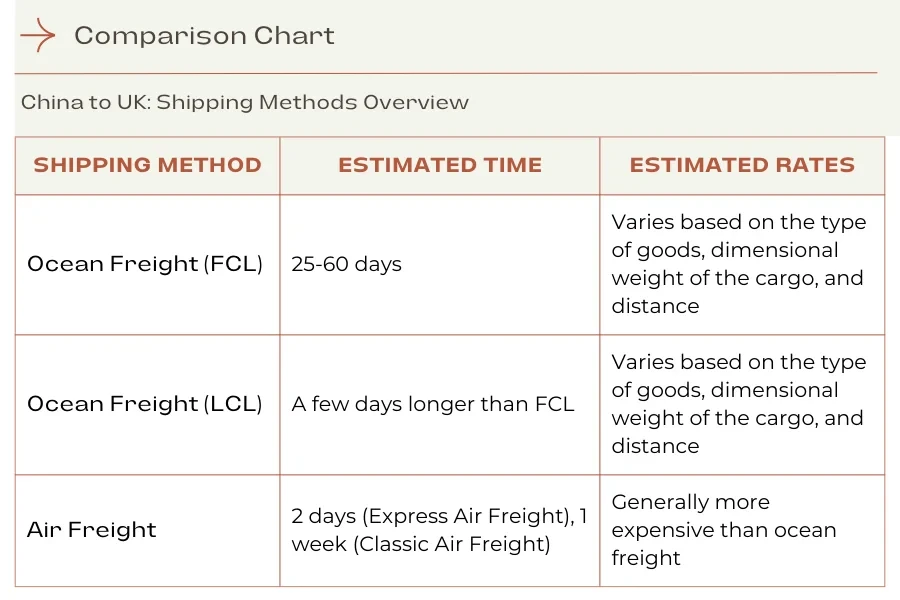

Itheyibhile engezantsi inika isishwankathelo seendlela ezahlukeneyo zokuthumela ngenqanawa ukusuka eTshayina ukuya e-UK, kunye namaxesha azo aqikelelweyo kunye namaxabiso:

Ukufumana izicatshulwa ezichanekileyo kunye namaxesha okuthumela ukusuka eChina ukuya e-UK, ngokuqwalasela uhlobo lweempahla, kunye nobukhulu bazo kunye nobunzima, tyelela Chovm.com Logistics Marketplace. Apha, amashishini anokunxibelelana nokukhokela abathumeli bempahla, thelekisa izicaphulo ezahlukeneyo, kwaye uphonononge uluhlu lweenkonzo zolungiselelo, kubandakanywa izibuko ukuya kwizibuko kwaye Kwindlu ngendlu iinkonzo.

4. Lungisa amaxwebhu okuthumela

Nje ukuba indawo yempahla ibhukishwe kunye nomthumeli wempahla kwaye iimpahla zilungele ukuthunyelwa ukusuka eTshayina ukuya e-UK, lixesha lokulungiselela okuyimfuneko. amaxwebhu okuthumela. Ngelixa amaxwebhu afunekayo anokwahluka ngokuxhomekeke kwimpahla ethile ethunyelwa ngaphandle, oku kulandelayo kuyafuneka kuzo zonke izinto ezithunyelwayo:

- I-invoyisi yentengiso: Olu xwebhu yibhili eneenkcukacha ezinikezelwe ngumthumeli ngaphandle kumrhwebi. Ibandakanya ulwazi olubalulekileyo olunjengokuchazwa kwempahla, ixabiso lilonke lezithethe kunye ne-inshurensi, ubungakanani, ubunzima, kunye nemigaqo yokuthengisa (umzekelo, ii-Incoterms). Abaphathi bempahla ephumayo basebenzisa olu xwebhu ukuze bagqibe ngemisebenzi kunye neerhafu ezityalwayo.

- Uluhlu lokupakisha: Ukukhapha i-invoyisi yorhwebo, uluhlu lokupakisha luchaza imixholo yephakheji nganye okanye ukuthunyelwa. Ichaza iintlobo, ubuninzi, kunye nobunzima beemveliso ezithunyelwayo. Olu xwebhu lunceda kwinkqubo yokungena kwizithethe kwaye luncedisa ekukhupheni.

- Ibhili yokuLading okanye i-Air Waybill:

- Ityala lokhwela (B/L) isetyenziselwa ukuthutha elwandle kwaye isebenza njengesivumelwano phakathi komnini wempahla kunye nomthwali. Isebenza njengerisithi yempahla ethunyelweyo kwaye ingasetyenziselwa ukufaka ibango lokuziswa kwempahla.

- Umoya wendlela wetyala (AWB) ngumlinganiso we-B/L osetyenziselwa ukuthutha umoya. Yikhontrakthi yekhareji ebandakanya ukulandelwa kokuthunyelwa kunye nobungqina bokufunyanwa.

- Isatifikethi semvelaphi: Ichaza apho iimpahla zenziwe (okanye "zavela") kwaye zinokufunwa kwiintlobo ezithile zeempahla ukumisela amaxabiso entlawulo okanye ukuba iimpahla zivunyelwe ngokusemthethweni ukuba zingeniswe e-UK. Iindidi zemizekelo ezifuna olu xwebhu ziquka iimveliso zezolimo, amalaphu, kunye nombane.

- Ilayisensi yokungenisa elizweni: Oku kuyafuneka ekungeniseni ngaphandle iindidi ezithile zeempahla ezinokulawulwa okanye ezilawulwayo. Imizekelo yeendidi ezifuna ilayisenisi yokungenisa elizweni e-UK ibandakanya imipu, izityalo, izilwanyana, kunye neekhemikhali ezithile kunye namayeza.

- C88/SAD (Uxwebhu lolawulo olulodwa) ifomu: Le yeyona ndlela iphambili yesithethe esetyenziswa kurhwebo lwamazwe ngamazwe ukuya okanye ukusuka kwi-EU, kuquka ne-UK. Inika iinkcukacha ngentshukumo yeempahla kwaye isebenza njengesibhengezo esisemthethweni sokungenisa elizweni. Ifomu isetyenziselwa ukubhengeza ukungenisa, ukuthunyelwa ngaphandle, kunye nempahla edlula e-UK, inika iinkcukacha ezifana nexabiso, inkcazo, kunye nemvelaphi yempahla.

5. Hlawula iirhafu kunye nemisebenzi

Nje ukuba iimpahla zifike e-UK, inyathelo lokugqibela kukuhlawula iirhafu kunye nemisebenzi. Kuphela emva kokuba amashishini ehlawule ezi ntlawulo ezinokuthi iimpahla zicace ngokusemthethweni amasiko, zingene ngokusemthethweni e-UK, kwaye zihanjiswe kwindawo yazo yokugqibela.

I-HMRC ivavanya amaxwebhu okuthumela ukusuka kwisinyathelo sangaphambili ukuvavanya iimpahla kunye nokumisela iirhafu ezifanelekileyo kunye nemisebenzi, esekelwe kuhlobo, ixabiso, kunye nemvelaphi yempahla.

Ukuqonda inkqubo yokubala irhafu kunye nomsebenzi, makhe sibe nomfanekiso-ngqondweni wemeko apho inkampani yefenitshala iceba ukungenisa ibhetshi yezitulo zomthi ukusuka eTshayina ukuya e-UK.

Inyathelo 1: Chonga ikhowudi yorhwebo (ikhowudi ye-HS)

Ikhowudi yorhwebo, okanye inkqubo ehambelanayo (HS) ikhowudi, lulandelelwano lwamanani asetyenziselwa ukwahlula iimpahla zokungenisa kunye nokuthunyelwa ngaphandle kwe-UK kunye nakwamanye amazwe. Inkampani yefenitshala inokufumana ikhowudi yempahla yezitulo zamaplanga ngokusebenzisa ii-HMRC's Isixhobo seRhafu yoRhwebo.

Ngokufaka imveliso isitulo esenziwe ngomthi, esenziwe ngokuchwela bafumana ikhowudi ye-HS enamanani ali-10. 9403 6010 00 kwizitulo zokhuni ezenzelwe ukutya.

Inyathelo lesi-2: Bala ixabiso lempahla

Emva koko, inkampani yefenitshala ibala iindleko ezihlawulweyo okanye ezihlawulwayo kwimpahla. Eli xabiso liya kuba lixabiso elisisiseko ekubaleni irhafu yempahla ethengwayo kunye neVAT yokungenisa elizweni.

- Ixabiso eliqikelelweyo lezitulo: USD 5,000

- Iindleko zokuthumela ngenqanawa: USD 500

- Ininshurensi: USD 100

Ukudibanisa ezi kunye kunika itotali ye USD 5,600.

Inyathelo 3: Khetha CIF okanye FOB

Emva koko, inkampani kufuneka ithathe isigqibo sokuba yeyiphi Incoterm ukusetyenziselwa iinjongo zomsebenzi kunye nerhafu: i-CIF (Iindleko, i-Inshurensi, kunye noThutho) ukuba banenjongo yokubandakanya iindleko zokuthumela kunye ne-inshurensi emsebenzini kunye nokubalwa kwerhafu, okanye Fob (Free On Board) ukuba bakhetha ukungafaki ezi ndleko.

Ngokomzekelo wethu, inkampani yefenitshala ithatha isigqibo sokuhamba ne-CIF, oku kuthetha ukuba iindleko zokuthumela kunye ne-inshurensi zibandakanyiwe ekubalweni komsebenzi. Olu balo luhambelana netotali yethu ye USD 5,600.

Inyathelo lesi-4: Bala irhafu yokuthenga ngaphandle kunye ne-VAT

Uxanduva lokuthatha ngaphandle:

Ikhowudi yorhwebo 9403 6010 00 unomlinganiselo womsebenzi owabelweyo we-2%. (Le ntlawulo inikezelwe ngeenjongo zokubonisa kulo mzekelo; amashishini kufuneka aqinisekise iireyithi zangoku nge iwebhusayithi esemthethweni ye-HMRC.)

Umrhumo wokungenisa elizweni = 2% ye-USD 5,600 = USD 112

Ubalo lwe-VAT:

I-VAT ibalwa ngokwesambuku sexabiso lempahla kunye nayo nayiphi na imisebenzi, iirhafu, kunye neendleko ezongezelelweyo ezifana nothutho kunye ne-inshurensi. Okokuqala, kufuneka sishwankathele iindleko zeempahla, zokuthumela, i-inshurensi, kunye nomsebenzi: USD 5,600 + USD 112 = USD 5,712

I-VAT ihlawuliswa ngexabiso eliqhelekileyo, eliyi-20% njengohlaziyo lokugqibela (Oku kunokutshintsha, ngoko hlala ujonge izinga le-VAT yangoku).

I-VAT = 20% ye-USD 5,712 = USD 1,142.40

Ke, ukushwankathela:

- Ixabiso lilonke lempahla (kubandakanywa neCIF): USD 5,600

- Uxanduva lokuthatha ngaphandle: USD 112

- IVAT: USD 1,142.40

- Ixabiso lilonke lokungenisa elizweni: USD 5,600 (ixabiso lempahla + i-inshurensi + yomthwalo) + USD 112 (umsebenzi) + USD 1,142.40 (VAT) = USD 6,854.40

Inkampani yefenitshala kulo mzekelo ingalindela ukuhlawula USD 6,854.40 ukungenisa izitulo e-UK.

Yenza lula inkqubo yokungenisa e-UK kunye nee-customs brokers

Ukuyibilisa, inkqubo yokungenisa ukusuka e-China ukuya e-UK inokushwankathelwa ngamanyathelo amahlanu abalulekileyo: ukuphanda ukuthotyelwa kwemveliso, ukufumana iilayisenisi eziyimfuneko kunye nokubhaliswa, ukukhetha indlela yokuthutha, ukulungiselela nokuhambisa amaxwebhu afunekayo okuthumela, kwaye ekugqibeleni, ukuhlawula imisebenzi kunye neerhafu zokucima iimpahla ezivela kumasiko.

Umrhwebi wamasiko unokuncedisa iinkampani ezithumela ngaphandle ngokulawula onke la manyathelo, ngaloo ndlela enze ukuhamba komsebenzi wokudlulisa iimpahla ukusuka eTshayina ukuya e-UK kube lula. Ngaphandle kobuchule babo bokuphatha amaphepha kunye nokuhamba ngemithetho yezithethe, abarhwebi bamasiko bagcina unxibelelwano oluthe rhoqo kunye nabasemagunyeni kwaye bahlala besebenzisa iinkqubo ze-elektroniki ezinokukhawulezisa inkqubo yokucima.

Phuma kwesi sikhokelo ukufunda ngakumbi malunga nabathengi bempahla kunye nendlela yokukhetha enye ehambelana neemfuno zakho zokungenisa elizweni. Ngoko ulindele ntoni? Qalisa ngokuphonononga i I-European Pavilion kwi-Chovm.com, apho abathengi bamashishini banokufumana izigidi zeemveliso ze-EU kunye ne-UK-eziqinisekisiweyo ngokucofa nje iqhosha elivela kubaboneleli abaphambili!

Ngaba ujonge isisombululo solungiselelo kunye namaxabiso okukhuphisana, ukubonakala okupheleleyo, kunye nenkxaso yomthengi efikelelekayo? Jonga i Chovm.com Logistics Marketplace namhlanje.

বাংলা

বাংলা Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch हिन्दी

हिन्दी Bahasa Indonesia

Bahasa Indonesia Italiano

Italiano 日本語

日本語 한국어

한국어 Bahasa Melayu

Bahasa Melayu മലയാളം

മലയാളം پښتو

پښتو فارسی

فارسی Polski

Polski Português

Português Русский

Русский Español

Español Kiswahili

Kiswahili ไทย

ไทย Türkçe

Türkçe اردو

اردو Tiếng Việt

Tiếng Việt isiXhosa

isiXhosa Zulu

Zulu