I-United Kingdom (UK) imele imakethe enenzuzo yokungenisa imikhiqizo ehlukahlukene, kusukela empahleni ewubukhazikhazi kuya ezintweni zansuku zonke. Isisekelo sazo sabathengi sinamandla amakhulu okuthenga, nezindleko zokusetshenziswa kwasekhaya zifinyelela cishe I-USD 1.894 isigidintathu ngo-2022. Lesi sibalo sicishe silingane nayo yonke imali esetshenziswa emakhaya Afrika ngo-2021.

Ngaphezu kwalokho, i-UK inenye yezimakethe ezithuthuke kakhulu ze-e-commerce emhlabeni, enengxenye enkulu yabathengi ukuthenga okwenzeka ku-inthanethi. Lokhu kuvumela amabhizinisi amazwe ngamazwe ukuthi athengise izimpahla ezivela kwamanye amazwe ngaphandle kokuthola ubukhona ngokoqobo e-UK. Ngakho-ke, akumangazi ukuthi inani lempahla ephelele engeniswe e-UK ezinyangeni eziyi-12 eziholela kuJanuwari 2024 lifinyelele cishe I-USD 1.204 trillion.

Kodwa-ke, inqubo yokungenisa izimpahla e-UK ihilela imisebenzi eminingi eyinkimbinkimbi kanye nemibhalo, kusukela ekuhleleni nasekuhleleni ukuthuthwa kwempahla kuya ekulungiseleleni nasekuthumeleni imibhalo yokuthumela ukuze kuhlangatshezwane nezidingo zamasiko zase-UK.

Ngaphezu kwalokho, njengoba i-UK inqume ukushiya i-European Union, eyaziwa ngokuthi I-Brexit, amasheke amasha entela, izivumelwano zohwebo, nokwanda okuphawulekayo kwamaphepha adingekayo kuye kwethulwa.

Kodwa akukho ukukhathazeka! Qhubeka nokufunda njengoba senza lula yonke inqubo yokungenisa izimpahla e-China zisuka e-China ziye e-UK kulokhu okuthunyelwe kwebhulogi, sikuhlukanise kube izinyathelo ezinhlanu nje ezilula!

Okuqukethwe

1. Kungani amabhizinisi kufanele angenise izimpahla ezivela eShayina?

2. Ngenisa izimpahla ezivela e-China ziye e-UK ngezinyathelo ezi-5

3. Yenza kube lula inqubo yokungenisa e-UK nabathengi bempahla

Kungani amabhizinisi kufanele angenise izimpahla ezivela eChina?

Ngaphambi kokuhlola inqubo eyizinyathelo ezinhlanu zokungenisa izimpahla e-China e-UK, umuntu angase abuze, "Kungani ungenisa kusuka eChina kwasekuqaleni?" Ngezansi kunezizathu ezine ezenza iChina ibe umthombo okhangayo wemikhiqizo yezinkampani zomhlaba:

Amandla amakhulu wokukhiqiza

Isizathu esiyinhloko sokuthi i-China ithathwe njengomthombo omuhle wamabhizinisi afuna ukungenisa izimpahla ukuqashelwa kwayo “njengemboni yomhlaba wonke.” Ngo-2021, iChina yamela 30% komkhiqizo wokukhiqiza emhlabeni wonke, futhi lesi sibalo sakhula saba I-USD 4.98 trillion e 2022.

Nakuba iminyaka eminingi, "Made in China” ilebula ibixhunyaniswe nezinto ezikhiqizwe ngobuningi zekhwalithi eshibhile nephansi, isanda kukhombisa ukusungulwa, ikhwalithi, kanye nokukhiqiza okuthuthukile. Lolu shintsho ludalwe ukutshalwa kwezimali okubalulekile okwenziwe uhulumeni wase-China emikhakheni yezobuchwepheshe, okuhlanganisa amarobhothi, i-aerospace, nezimoto zamandla ahlanzekile.

Izindleko eziphansi zabasebenzi

Ngokomlando, izindleko eziphansi zabasebenzi eShayina kube ngenye yezinto eziheha izinkampani zomhlaba ukuthi zingagcini ngokuthola nokungenisa izimpahla ezivela ezweni kodwa futhi zithuthe izindawo zazo zokukhiqiza.

Nakuba kuyiqiniso ukuthi izindleko zabasebenzi e-China zinyukile eminyakeni embalwa edlule, ngokuvamile zihlala ziphansi kunamazwe amaningi aseYurophu naseNyakatho Melika. Amaholo aphansi awasikiseli izimo zokusebenza ezingezinhle njengoba ngokuvamile ehlobene nezindleko eziphansi zokuphila. Ngokwesibonelo, ukuhlala e-China kuyinto I-72% eshibhile kunase-United States.

Ukufinyelela kubuchwepheshe obusafufusa

I-China futhi yenza izinguquko endleleni imikhiqizo eklanywa futhi ekhiqizwa ngayo. Umkhakha wokukhiqiza waseChina utshale kakhulu kubuchwepheshe obukhaliphile obenza amafekthri ahlakaniphe kakhulu futhi axhumeke.

Ukwengeza, i-China iyinhlangano umholi womhlaba ekuhanjisweni kwamarobhothi kanye okuzenzakalelayo ekukhiqizeni. Izimboni ezihlakaniphile zaseShayina nazo ziyasebenzisa 3D zokunyathelisa, ukwenza lula ukwenziwa kwe-prototyping ngokushesha, ukusetshenziswa kahle kwezinto ezibonakalayo, nokudalwa kwezakhiwo eziyinkimbinkimbi izindlela zokukhiqiza ezingokwesiko ezingakwazi ukuzifeza kalula.

Le ntuthuko ihlinzeka izinkampani zomhlaba wonke ukufinyelela kubuchwepheshe obusha, ziqinisekisa ukunemba, isivinini, nokusebenza kahle emigqeni yokukhiqiza, kusukela kumishini kagesi yabathengi kuya ezimotweni.

Amasistimu ezinto eziphilayo aqinile futhi axhumene

Isimo seShayina njengesizinda somhlaba wonke sokukhiqiza kanye nokufunwa kwezimpahla asimane nje sibalulwe ngenxa yabasebenzi abanekhono, abathengekayo noma umthamo wabo omkhulu wokukhiqiza. Kuphinde kube ngenxa yesimo semvelo sebhizinisi esithuthuke kahle ezweni. Lokhu kubandakanya inethiwekhi eqinile yabahlinzeki, abakhiqizi, nezinkampani zezokuthutha.

Ngaphezu kwalokho, i-China idume ngakho amaqoqo ezimboni, okuyizifunda ezigxile ngokwendawo zezinkampani ezixhumene, abahlinzeki abakhethekile, nabahlinzeki besevisi. I-ecosystem exhumene kanjalo iqinisekisa ukuthi isigaba ngasinye sochungechunge lokukhiqiza, kusukela ekutholeni impahla eluhlaza kuye ekukhiqizeni kuya ekulethweni kokugcina, silungiselelwa isivinini kanye nokonga kwezindleko.

Ngenisa impahla esuka e-China iye e-UK ngezinyathelo ezi-5

Manje njengoba sesiqonda ukuthi kungani i-China iyisikhungo sokuhamba phambili sokukhiqiza nokuthola izimpahla, ake sihlole ukuthi amabhizinisi angaqala kanjani ukungenisa izimpahla e-China e-UK ngezinyathelo ezinhlanu:

1. Cwaninga ukuthotshelwa kwezimpahla ezingenisiwe

Lapho ungenisa impahla esuka e-China ukuya e-UK, isinyathelo sokuqala sibandakanya ukuqinisekisa ukuthi imikhiqizo ithobela imithetho nezindinganiso zase-UK ezifanele. Ngemikhiqizo eminingi ehloselwe ukudayiswa eGreat Britain, uMnyango Wezamabhizinisi Nohwebo (DBT) idinga amabhizinisi ukuthi athole esinye sezitifiketi ezimbili eziyinhloko:

- UKCA (Ukuvumelana kwe-UK Kuhlolwe): Lolu phawu lokuvumelana lubonisa ukuthi umkhiqizo uhlangabezana nezimfuneko zokulawula ezithengiswayo ngaphakathi kwe-Great Britain (England, Scotland, and Wales). Ihlanganisa izimpahla eziningi, okuhlanganisa, kodwa kungagcini lapho, amathoyizi, izinto zikagesi, nemikhiqizo yokwakha.

- Ukumaka kwe-CE: Lokhu Ubumbano lwaseYurophu uphawu lubonisa ukuthobela umkhiqizo nazo zonke izimfuneko ezisebenzayo zokulawula ze-European Union (EU) eziphathelene nempilo, ukuphepha, nokuvikelwa kwemvelo.

Ngenkathi i-UK izoqhubeka nokubona uphawu lwe-CE unomphela ezimpahleni eziningi ezibekwe emakethe e-Great Britain, ukumakwa kwe-UKCA kwaba yimpoqo emva kwe-Brexit emikhiqizweni emisha engena emakethe ye-GB noma lapho imithetho eqondene ne-UK ihluka ezindinganisweni ze-EU.

Kuhle ukuqaphela ukuthi izitifiketi ezengeziwe, ukuhlolwa kokuphepha, noma izimemezelo zokuvumelana kungase kudingeke kweminye imikhiqizo. Isibonelo, ukugunyazwa kwe-Medicines and Healthcare products Regulatory Agency (UMHRA) iyadingeka ekuthengisweni kwemithi ehloselwe ukusetshenziswa abantu noma udokotela wezilwane.

Ngaphezu kwalokho, izimpahla ezithile zivinjelwe noma zivinjelwe ngokuphelele ukuthi zingangeniswa e-UK, kungakhathaliseki ukuthi zithathwe e-China noma kwenye indawo. Isibonelo, ukungeniswa kwezidakamizwa ezilawulwayo, okuhlanganisa izidakamizwa nezinto ezithinta ingqondo, akuvunyelwe ngaphansi komthetho wase-UK.

2. Thola ukubhaliswa okudingekayo kanye nokuhlonza

Uma izinkampani ezihwebayo seziqinisekise ukuthi izimpahla ezihloselwe ukungenisa zithobela yonke imithetho nezindinganiso zaseBrithani ezidingekayo, isinyathelo esilandelayo siwukubhalisa ukuhlonza okubili okubalulekile, njengoba kuyalelwe yi-HM Revenue and Customs (I-HMRC):

2.1 Inombolo ye-EORI

Amabhizinisi adingeka ukuthi athole Ukubhaliswa Kwe-Economic Operator and Identification (I-EORI) inombolo yokungenisa izimpahla e-UK. Lesi sihlonzi esiyingqayizivele sabelwe kokubili izinkampani nakubantu ngabanye abenza uhwebo lwamazwe ngamazwe ne-Europe, kuhlanganise ne-UK, ngemva kwe-Brexit.

Bonke abathengisi badinga inguqulo yase-UK yale nombolo ukuze bahambise noma bakhiphe izimpahla e-Great Britain, Northern Ireland, noma e-Isle of Man, kanye naphakathi kwe-Great Britain namanye amazwe. Ukuba nenombolo ye-EORI kuyadingeka ekuthumeleni izimemezelo zentela kanye nokuthola imvume kwabaphathi bempahla yase-UK (HMRC).

2.2 I-VAT (uyazikhethela)

Ngaphezu kwalokho, kungase kube yinzuzo kumabhizinisi bhalisela i-VAT (I-Value Added Tax) uma befisa ukuphinda bafune i-VAT ekhokhwa ezimpahleni ezingenisiwe. Nakuba ukubhaliswa kwe-VAT kungadingeki kubo bonke abangenisayo, kungase kunikeze izinzuzo zezezimali kulabo abangena njalo nge-VAT ezintweni ezithengwayo.

Njengesibonelo, zicabange ungenisa izingxenye zikagesi ezibiza u-USD 100,000 e-UK, futhi ukhokhiswa i-VAT engu-20% uma ungena. Lokhu kusho ukuthi uzokhokha u-USD 20,000 ku-VAT. Uma ubhalisele i-VAT, ungaphinda ufune le VAT engu-USD 20,000 ku-VAT Return yakho, inqobo nje uma izimpahla zisetshenziselwa ibhizinisi.

3. Hlela indlela yokuthumela

Manje njengoba izinkampani zithole izitifiketi ezidingekayo zomkhiqizo futhi zaqinisekisa ukuthi ukukhonjwa kwebhizinisi lazo kulungile, isinyathelo esilandelayo sibandakanya ukunquma ukuthi izimpahla zizofika kanjani e-UK.

Imvamisa, amabhizinisi angakhetha phakathi kwezimpahla zomoya noma zasolwandle noma akhethe inhlanganisela yalezi zindlela nomgwaqo wendawo noma izixazululo zesitimela ukulethwa kwemayela lokugcina ngaphakathi e-UK:

- Ukuthuthwa komoya: Lena inketho eshesha kakhulu yokuthutha izimpahla phakathi kweChina ne-UK. Ilungele izinto eziphuthumayo noma ezibolayo, iqinisekisa ukuthi zifika lapho ziya khona ngesikhathi esifushane kakhulu. Ukuhwebelana kwalesi sivinini kuyizindleko eziphezulu, okwenza kube indlela yokuthutha ebiza kakhulu.

- Ezokuthutha zasolwandle: Inketho engabizi kakhulu yokungenisa izimpahla ezinkulu, ezinkulu, noma ezinzima ezivela e-China. Yize le ndlela ihamba kancane kakhulu kunezokuthutha emoyeni, inikeza ukonga okubalulekile kwempahla engazweli ngesikhathi, iyenze ilungele umthamo omkhulu.

- Eziningi or ukuthuthwa kwe-intermodal: Lezi zindlela zihlanganisa izindlela ezihlukahlukene zokuhamba. Isibonelo, izimpahla zingathunyelwa ngempahla yasolwandle ziye echwebeni lase-UK, bese kulandelwa umzila wesitimela noma umgwaqo ukuya endaweni yokugcina. Le ndlela ithinta ibhalansi phakathi kwesikhathi nezindleko, isebenzise ukuphumelela kwezindleko zokuthutha olwandle okuhambisana nokunemba, ukulethwa kwendawo okunikezwa amanethiwekhi emigwaqo noma amasistimu kaloliwe.

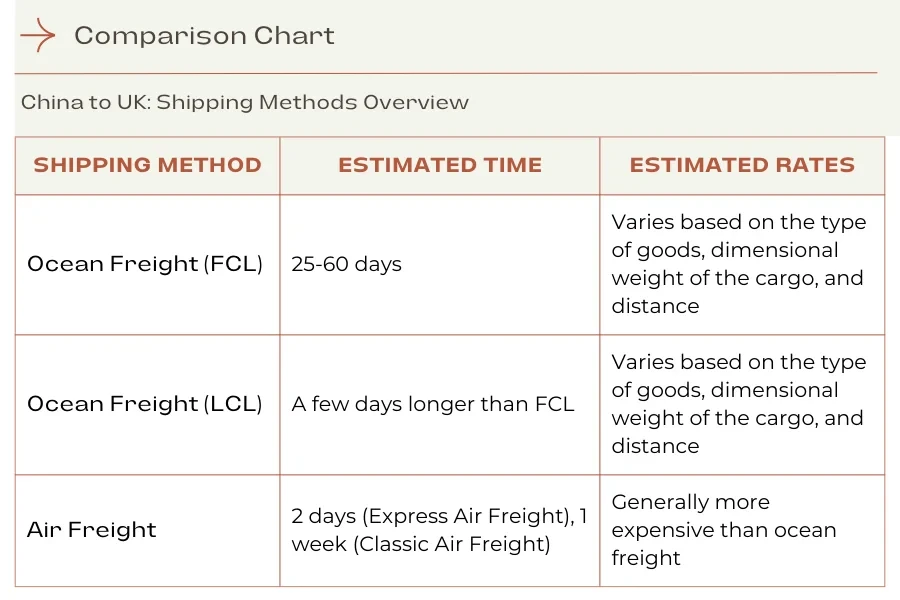

Ithebula elingezansi linikeza isifinyezo sezindlela ezihlukene zokuthutha ezisuka e-China ziye e-UK, kanye nezikhathi zazo ezilinganiselwe namanani:

Ukuze uthole izingcaphuno ezinembile nezikhathi zokuthumela ezivela e-China ukuya e-UK, ngokucabangela uhlobo lwezimpahla, kanye nobukhulu bazo nesisindo, vakashela I-Chovm.com Logistics Marketplace. Lapha, amabhizinisi angaxhuma nokuhola abathutha impahla, qhathanisa izingcaphuno ezihlukahlukene, futhi uhlole ububanzi bezinsizakalo zezokuthutha, okuhlanganisa port-to-port futhi umnyango nomuzi amasevisi.

4. Lungiselela imibhalo yokuthunyelwa

Uma indawo yempahla isibhukwe nomthumeli wezimpahla futhi izimpahla sezilungele ukuthunyelwa zisuka eChina ziye e-UK, sekuyisikhathi sokulungiselela okudingekayo. izincwadi zokuthumela. Yize imibhalo edingekayo ingahluka kuye ngezimpahla ezithile ezingenisiwe, okulandelayo kuvame ukudingeka kukho konke ukuthunyelwa:

- I-invoyisi yezentengiso: Lo mbhalo uyibhili enemininingwane ehlinzekwa ngumthumeli kwamanye amazwe kumthengisi. Kuhlanganisa ulwazi olubalulekile olufana nencazelo yezimpahla, inani eliphelele lamasiko nomshwalense, inani, isisindo, kanye nemibandela yokuthengisa (isb, ama-Incoterms). Iziphathimandla zentela zisebenzisa lo mbhalo ukuze zinqume imisebenzi nezintela ezikweletwayo.

- Uhlu lokupakisha: Ihambisana ne-invoyisi yokuhweba, uhlu lokupakisha luqukethe okuqukethwe kwephakheji ngayinye noma ukuthunyelwa. Ichaza ngezinhlobo, amanani, nezisindo zemikhiqizo ethunyelwe. Lo mbhalo usiza enqubweni yokungena emasikweni futhi usiza ekukhipheni impahla.

- I-Bill of Lading noma i-Air Waybill:

- I-invoyisi (B/L) isetshenziselwa ukuthutha olwandle futhi isebenza njengenkontileka phakathi komnikazi wezimpahla kanye nomthwali. Isebenza njengerisidi yezinto ezithunyelwayo futhi ingasetshenziselwa ukufuna ukulethwa kwezimpahla.

- I-Air Waybill (AWB) ilingana ne-B/L esetshenziselwa ukuthutha emoyeni. Kuyinkontileka yenqola ehlanganisa ukulandelela ukuthunyelwa kanye nobufakazi bokuthola.

- Isitifiketi Somsuka: Isho ukuthi izimpahla zakhiqizwa kuphi (noma “zavela”) futhi kungase kudingeke ezinhlotsheni ezithile zezimpahla ukuze kunqunywe amanani entengo noma uma izimpahla zivunyelwe ngokusemthethweni ukuthi zingeniswe e-UK. Izigaba eziyisibonelo ezidinga lo mbhalo zihlanganisa imikhiqizo yezolimo, izindwangu, nezinto zikagesi.

- Ilayisensi yokungenisa: Lokhu kuyadingeka ekungeniseni izigaba ezithile zezimpahla ezingase zilawulwe noma zilawulwe. Izibonelo zezigaba ezidinga ilayisense yokungenisa e-UK zifaka izibhamu, izitshalo, izilwane, namakhemikhali athile kanye nemithi.

- I-C88/SAD (Idokhumenti Yokuphatha Eyodwa) ifomu: Leli ifomu lesiko eliyinhloko elisetshenziswa ekuhwebeni kwamazwe ngamazwe ukuya noma ukusuka e-EU, okuhlanganisa ne-UK. Ichaza kabanzi ngokuthuthwa kwezimpahla futhi isebenza njengesimemezelo esisemthethweni sokungeniswa kwamanye amazwe. Ifomu lisetshenziselwa ukumemezela ukungenisa, ukuthunyelwa, nezimpahla ezidlula e-UK, linikeza imininingwane efana nenani, incazelo, kanye nemvelaphi yezimpahla.

5. Khokha izintela kanye nentela evela kwamanye amazwe

Uma izimpahla sezifikile e-UK, isinyathelo sokugcina ukukhokha izintela nentela yokungenisa. Kuphela ngemva kokuba amabhizinisi esekhokhe lezi zindleko lapho izimpahla zisusa khona ngokomthetho amasiko, zingene ngokusemthethweni e-UK, futhi zilethwe lapho ziya khona ekugcineni.

I-HMRC ihlola amadokhumenti okuthumela kusukela esinyathelweni sangaphambilini ukuze ihlole izimpahla futhi inqume izintela ezifanele nemisebenzi, esekelwe ohlotsheni, inani, nomsuka wezimpahla.

Ukuze siqonde inqubo yokubala intela nomsebenzi, ake sicabange ngesimo lapho inkampani yefenisha ihlela ukungenisa inqwaba yezihlalo zamapulangwe e-UK isuka e-China.

Isinyathelo 1: Thola ikhodi yempahla (ikhodi ye-HS)

Ikhodi yempahla, noma isistimu evumelanisiwe (HS) ikhodi, ukulandelana kwezinombolo ezisetshenziselwa ukuhlukanisa izimpahla ukuze zingeniswe futhi zithunyelwe ngaphakathi e-UK nakwamanye amazwe. Inkampani yefenisha ingathola ikhodi yempahla yezihlalo zamapulangwe ngokusebenzisa ama-HMRC Ithuluzi le-Trade Tariff.

Ngokufaka ukuthi umkhiqizo uyisihlalo esenziwe ngokhuni, esakhiwe ngokubaza bathola ikhodi ye-HS enamadijithi ayi-10. 9403 6010 00 zezihlalo zokhuni ezenzelwe ukudla.

Isinyathelo sesi-2: Bala inani lempahla

Okulandelayo, inkampani yefenisha ibala izindleko ezikhokhwayo noma ezikhokhwayo ezimpahleni. Leli nani lizoba inani eliyisisekelo lokubala intela yentela kanye ne-VAT yokungenisa.

- Inani elilinganiselwe lezihlalo: I-USD 5,000

- Izindleko zokuthumela: I-USD 500

- Umshuwalense: I-USD 100

Ukuhlanganisa lezi ndawonye kunikeza inani I-USD 5,600.

Isinyathelo sesi-3: Khetha i-CIF noma i-FOB

Ngemuva kwalokho, inkampani kufanele inqume ukuthi iyiphi Incoterm ukusetshenzisela izinjongo zomsebenzi nezentela: I-CIF (Izindleko, Umshwalense, kanye Nezimpahla) uma behlose ukuhlanganisa izindleko zokuthutha nezomshwalense ekubalweni komsebenzi kanye nentela, noma Fob (Kumahhala Ebhodini) uma bekhetha ukungafaki lezi zindleko.

Esibonelweni sethu, inkampani yefenisha inquma ukuhamba ne-CIF, okusho ukuthi izindleko zokuthumela nezomshuwalense zifakiwe ekubalweni komsebenzi. Lesi sibalo siqondana nengqikithi yethu ye I-USD 5,600.

Isinyathelo sesi-4: Bala intela yokungenisa kanye ne-VAT

Umsebenzi wokungenisa:

Ikhodi yempahla 9403 6010 00 inenani lomsebenzi elinikeziwe elingu-2%. (Leli zinga linikezwe izinjongo zemifanekiso kulesi sibonelo; amabhizinisi kufanele aqinisekise amanani amanje nge- Iwebhusayithi esemthethweni ye-HMRC.)

Umsebenzi wokungenisa = 2% we-USD 5,600 = I-USD 112

Ukubalwa kwe-VAT:

I-VAT ibalwa ngesamba senani lezimpahla kanye nanoma yimiphi imisebenzi, izintela, kanye nezindleko ezengeziwe ezifana nempahla kanye nomshwalense. Okokuqala, sidinga ukwenza isamba sezindleko zezimpahla, ukuthunyelwa, umshwalense, kanye nomsebenzi: USD 5,600 + USD 112 = I-USD 5,712

I-VAT ikhokhiswa ngenani elijwayelekile, elingu-20% njengesibuyekezo sokugcina (Lokhu kungashintsha, ngakho-ke hlola njalo izinga le-VAT lamanje).

I-VAT = 20% ye-USD 5,712 = I-USD 1,142.40

Ngakho-ke, ukufingqa:

- Isamba sezindleko zezimpahla (kuhlanganise ne-CIF): I-USD 5,600

- Umsebenzi wokungenisa: I-USD 112

- I-VAT: I-USD 1,142.40

- Izindleko eziphelele zokungenisa: USD 5,600 (inani lempahla + umshwalense + wezimpahla) + USD 112 (umsebenzi) + USD 1,142.40 (VAT) = I-USD 6,854.40

Inkampani yefenisha kulesi sibonelo ingalindela ukukhokha I-USD 6,854.40 ukungenisa izihlalo e-UK.

Yenza kube lula inqubo yokungenisa e-UK ngama-Customs brokers

Ukuyibilisa, inqubo yokungenisa kusuka e-China ukuya e-UK ingafingqwa ngezinyathelo ezinhlanu ezibalulekile: ukucwaninga ukuthobela umkhiqizo, ukuthola amalayisense adingekayo nokubhaliswa, ukukhetha indlela yokuthumela, ukulungiselela nokuthumela imibhalo edingekayo yokuthumela, futhi ekugcineni, ukukhokha imisebenzi nezintela ukuze kususwe izimpahla ezivela kumasiko.

Umdayisi wempahla angakwazi ukusiza izinkampani ezingenisayo ngokuphatha zonke lezi zinyathelo, ngaleyo ndlela enze ukuhamba komsebenzi wokudlulisa izimpahla zisuka e-China ziye e-UK zibe bushelelezi kakhulu. Ngaphezu kobungcweti babo bokuphatha amaphepha kanye nokuzulazula kwemithetho yamasiko, abadayisi bempahla bagcina ukuxhumana njalo neziphathimandla zentela futhi ngokuvamile basebenzisa amasistimu kagesi angasheshisa inqubo yokukhipha imvume.

Hlola lo mhlahlandlela ukuze ufunde kabanzi mayelana nabathengi bezimpahla kanye nendlela yokukhetha ehambisana nezidingo zakho zokungenisa. Ngakho usalindeni? Qalisa ngokuhlola i- I-European Pavilion ku-Chovm.com, lapho abathengi bebhizinisi bengathola izigidi zemikhiqizo eqinisekisiwe ye-EU ne-UK ngokuchofoza inkinobho nje kubahlinzeki abaholayo!

Ingabe ufuna isixazululo sezinhlelo zokusebenza esinamanani ancintisanayo, ukubonakala okugcwele, nokusekelwa kwamakhasimende okufinyeleleka kalula? Hlola I-Chovm.com Logistics Marketplace namuhla.

Afrikaans

Afrikaans አማርኛ

አማርኛ العربية

العربية বাংলা

বাংলা Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch हिन्दी

हिन्दी Bahasa Indonesia

Bahasa Indonesia Italiano

Italiano 日本語

日本語 한국어

한국어 Bahasa Melayu

Bahasa Melayu മലയാളം

മലയാളം پښتو

پښتو فارسی

فارسی Polski

Polski Português

Português Русский

Русский Español

Español Kiswahili

Kiswahili ไทย

ไทย Türkçe

Türkçe اردو

اردو Tiếng Việt

Tiếng Việt isiXhosa

isiXhosa Zulu

Zulu