Njengoba umnotho uqala ukusimama kwawo ngo-2021, izimakethe zezimali zalandela okufanayo. Umsebenzi wokuhlanganisa nokutholwa (i-M&A) ufike ezingeni eliphezulu kakhulu kusukela ngo-2015, iqopha u-$5.1 trillion kumadili ngo-2021, ngokusho kwe-KPMG.

I-rebound kusuka ku-2020 ethule kulindeleke ukuthi iqhubeke kuze kube ngu-2022, nakuba kungase kube nezivumelwano ezimbalwa ngo-2022 kuno-2021.

Izilinganiso zenzalo ephansi zivumele uxhaso olubalulekile lokuthenga izinkampani ezinenani eliphezulu kakhulu. Njengoba izinga lenzalo likhuphuka, ukutshalwa kwezimali kokuqanjwa kabusha nomsebenzi wokuxhasa ngezimali kulindeleke ukuthi kuhambe kancane.

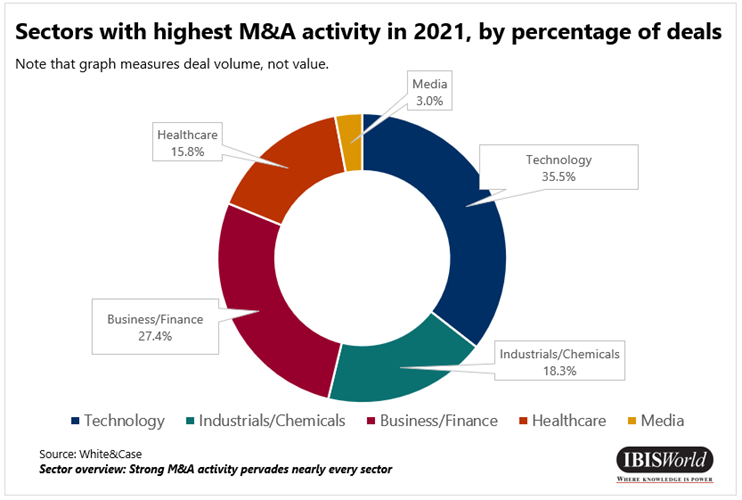

I-IBISWorld ibuyekeze imikhakha enomsebenzi omkhulu wokuhlanganisa nokutholwa ngo-2021 nango-2022.

Le mikhakha ichazwe kabanzi, okuhlanganisa ubuchwepheshe, izimboni namakhemikhali, ukunakekelwa kwezempilo, izinsizakalo zebhizinisi nezezimali kanye nabezindaba.

Amadili athile kanye nedatha yezimboni evela emibikweni ye-IBISWorld icacisa ukuthi yiziphi izinhlobo zezinkampani nezimakethe ezihlangabezane nenani lentengo ephezulu ngo-2021 nango-2022.

I-1. Ubuchwepheshe

Izinkampani zobuchwepheshe zithole umthamo omkhulu we-M&A ngo-2021, ngamadili angu-2,193, ngokusho kwenkampani yabameli i-White & Case. Yize kungumkhakha ochazwe kabanzi, izinkampani zobuchwepheshe zifaka abathuthukisi benkundla yezokwakha kanye nengqalasizinda kanye nonjiniyela bamarobhothi.

Ukutholwa kweHyundai Motor Company's (Hyundai) $1.1 billion yomthuthukisi wamarobhothi iBoston Dynamics kungesinye sezivumelwano ezibaluleke kakhulu zango-2021 kunoma yimuphi umkhakha.

Amadili amancane, afana nokutholwa kwe-Algolia kwe-Search.io, ithuluzi lokusesha lewebhu elinamandla e-AI, kanye nokutholwa kwe-Reliance Industries Limited kwe-SenseHawk Inc., inkundla yokuphatha amaphrojekthi wengqalasizinda yelanga, anikeza ukuqonda ngemvelo yamadili ezobuchwepheshe ngo-2022.

Izinkampani ezinkulu zivame ukuthenga izinkampani ezincane ezintsha ukuze zithuthukise ubuchwepheshe bazo, njengasendabeni yakwaHyundai ne-Algolia.

Izimboni eziphakela idili lobuchwepheshe zihlanganisa Izinsizakalo Zobunjiniyela e-US, Amasevisi e-Geophysical e-US futhi Ukuthuthukiswa Kwesayensi Nocwaningo e-US, kanti le mboni yakamuva ivamise ukuba seqhulwini lokuqanjwa kabusha nokuthengwa kwezobuchwepheshe.

Inani lamabhizinisi embonini Yokuthuthukiswa Kwesayensi Nocwaningo lenyuke ngokulinganiselwa ku-8.5% no-5.3% ngo-2021 nango-2022, ngokulandelana, okubonisa ukukhula okukhulayo kwezinkampani ezintsha ezisazotholwa.

2. Izimboni kanye Namakhemikhali

Umkhakha wezimboni namakhemikhali ithole amadili angu-1,127 ngo-2021, ngokusho kwenkampani yabameli i-White & Case.

Isibonelo, i-SK Capital Partners LP ithenge inzalo enkulu enkampanini yamakhemikhali i-Deltech LLC, ekhiqiza ama-monomer nama-polymer asetshenziselwa ukupakisha umkhiqizo, ngo-2021.

Umsebenzi waqhubekela phambili njengoba amafekthri nezitshalo kuvulwa kabusha futhi ukusebenza kwebhizinisi kubuyela kwesijwayelekile ngasekupheleni kuka-2020. Ukukhuphuka kwamaholo kanye nezindleko zokufakwayo kukhuthaze abakhiqizi nezinye izinkampani zezimboni ukuthi zifune ama-synergies ezindleko.

Izinkampani ezizimele kanye nezinkampani ezizimele sezingenile ukuze zisebenzise ithuba lokukhuphuka kwemali elindelekile yezinkampani zamandla nezinto zokwakha ngo-2022.

Izimboni ezishayela lo msebenzi we-M&A zifaka phakathi Imboni yePetrochemical Manufacturing, lo Imboni ye-Oil and Gas Field Services futhi Imboni yokuThutha Amandla kagesi. Izinga eliphezulu lemboni yezokukhiqiza i-Petrochemical Manufacturing, kanti izinkampani ezine ezinkulu okulindeleke ukuthi ziphendule u-69.1% wemali engenayo yemboni, igqamisa ukuvelela kokutholwayo.

3. Izinkonzo Zebhizinisi Nezezimali

Amabhizinisi ahlukahlukene avela cishe kuyo yonke imikhakha asebenzisa izinkampani zebhizinisi nezinkonzo zezezimali. Ngaphakathi komkhakha webhizinisi nowezezimali, izinkampani ezimbalwa zenze izindlela ezintsha zokuhlaziya idatha yebhizinisi, imali yokuboleka amakhasimende, ukwenza izinkokhelo zisebenze kahle kakhulu futhi zilawule ukuhamba komsebenzi.

Ngokwemvelo, izinkampani zesoftware zabusa umsebenzi walo mkhakha we-M&A ngo-2021 futhi cishe zizoqhubeka zikhanya ngo-2022. Izinsizakalo zebhizinisi nezezimali zengeze okwenziwayo okungu-1,691 kwe-M&A ngo-2021.

Laba opharetha bahlinzeka ngamasevisi kukho kokubili amabhizinisi nakubathengi. Inkampani yezinsizakalo zezezimali i-Stripe Inc. ithenge inkundla yokusebenza kwezezimali yase-India i-Recko ngo-2021. Ubuchwepheshe buka-Recko busiza amabhizinisi ukuphatha imali ngokuvumelanisa izinkokhelo, amadiphozithi, ukubuyiselwa kwemali nezinye izinqubo ezibalulekile zezimali.

Ngo-2022, iBlock Inc., umhlinzeki wobuchwepheshe besistimu yokukhokha yesikwele, yazuza i-Afterpay Limited, inkampani yezimali “yokuthenga manje, ukhokhe kamuva” ekhulisa ukuthengisa namandla okuthenga amabhizinisi amancane.

Amadili amakhulu kulo mkhakha nawo afaka nezinkampani ezivela imboni ye-Business Analytics kanye ne-Enterprise Software, imboni ye-HR kanye ne-Payroll Software, imboni yoCwaningo lwezimakethe futhi imboni Yokucubungula Amakhadi Esikweletu kanye Nokudlulisa Imali.

Izinkampani ze-HR kanye ne-Payroll Software zikhanga ikakhulukazi amafemu okutshalwa kwezimali njengoba isilinganiso se-EBIT/imali engenayo (imajini yokusebenza) sikhuphuke phakathi kuka-2017 no-2022.

4. Ukunakekela impilo

Ukunakekelwa kwezempilo kuqhubekile nokuthambekela kwakho kwevolumu ephezulu ye-M&A ku-2022; ngo-2021, lo mkhakha wenze izivumelwano ze-M&A ezingama-976. Izimboni ezibalulekile endaweni yokunakekelwa kwezempilo zihlanganisa imboni yokukhiqiza i-Brand Name Pharmaceutical Production futhi imboni Yokukhiqiza Imishini Yezokwelapha.

I-Biotechnology e-US kungenye imboni ebalulekile eqhuba umsebenzi we-M&A wokunakekelwa kwezempilo. Yaziwa ngezisombululo ezintsha namandla amakhulu emali engenayo, imboni ithanda ukuqagela ngabatshalizimali.

I-IBISWorld ilinganisela ukuthi inani lezinkampani ze-biotechnology likhule njalo ngonyaka ngo-7.5% phakathi neminyaka emihlanu kuya ku-2022. Abaqhubi abasha abangena esikhaleni kanye nokugxila ezimakethe eziphezulu kubonisa umsebenzi we-M&A ophezulu.

NgoMashi 2022, iPfizer Inc. yaqeda ukuthatha kwayo amabhiliyoni angu-6.7 e-Arena Pharmaceuticals Inc., inkampani enethemba lokwelapha izifo ezibangelwa amasosha omzimba. Lokhu kutholwa kumelele inkambiso evamile yezinkampani ezinkulu ezibhejela abasunguli abancane esikhundleni sokutshalwa kwezimali kocwaningo lwangaphakathi.

I-5. Imidiya

Ngaphandle kokuqopha amadili angama-186 ngo-2021, inani le-M&A lomkhakha wezindaba lifinyelele kuma-dollar ayizigidi eziyizinkulungwane ezingama-182.9. Njengoba ubhubhane lwe-COVID-19 luphushela abathengi emikhubeni yokusebenzisa ku-inthanethi, ukuzijabulisa kwasekhaya nokukhangisa kwedijithali kwachuma.

Amadili kulo mkhakha ahlanganisa ukuhlanganiswa kokusakaza-bukhoma nezinkundla zokuqukethwe ngaphezu kokuthengwa kwamalungelo omlingiswa namalungelo omkhiqizo wokukhiqiza okuqukethwe.

Ukuthenga kwe-Netflix Inc. kwamalungelo okuthi Charlie and the Chocolate Factory kanye nokuphuma kwe-AT&T Inc. kwe-Warner Brothers nokuhlanganiswa ne-Discovery Inc., enenani lamabhiliyoni angama-96.0, kuyisibonelo sezinhlobonhlobo zemisebenzi eyenzekayo esikhaleni semidiya.

Imboni Yokushicilelwa Kwe-inthanethi Nezokusakaza uphinde wabhekana nomsebenzi we-M&A ophezulu. Igalelo lale mboni emnothweni wonkana likhule ngenani laminyaka yonke lika-12.1% phakathi neminyaka eyi-10 kuya ku-2027, likhuphuke ngesivinini esikhulu kune-GDP yase-US, okubonisa ukuqhubeka kwayo ukubaluleka.

Yini manje?

Yize kuwucezu olubalulekile lwendida, amanani enzalo aphansi bekungewona ukuphela kwento eqhubekisela phambili umsebenzi we-M&A eminyakeni yakamuva.

Imikhiqizo emisha ezuzisa abathengi namabhizinisi iye yavela njengoba ubuchwepheshe budlala indima enkulu kwezomnotho nasezimpilweni zethu - le mikhiqizo emisha ixazulula amakhanda amancane futhi inikeza ukwelashwa okushintsha impilo yezifo.

Noma kunjalo, izilinganiso zenzalo ezikhuphukayo ziza nemali ephansi elindelekile, izici zesaphulelo eziphezulu kanye nezilinganiso eziphansi zamadili.

Imakethe ye-M&A, nokho, isivele ikhombisa izimpawu zokwehla ngo-2022. Ukuhlaziya okuvela kwaPricewaterhouseCoopers kukhomba Izivumelwano eziqinile ze-M&A, kodwa amanani entengo aphansi maphakathi nonyaka ka-2022 njengophawu lokungaqiniseki kwabatshalizimali kanye nesidingo esincane sokutholwa.

Ukushaqeka okungekuhle emnothweni nasezimakethe zezimali kulindeleke ukuthi kuqine ngo-2023, okuholela kumbono ongemuhle wemisebenzi ye-M&A.

Izimboni ezifuna ama-synergies wezindleko kanye nenzuzo ephezulu ngokuhlangana cishe zizobhekana nenani eliphakeme lamadili ngo-2023. Izimboni eziqagelayo ezinokugeleza kwemali okusazobonakala zizobona amadili ambalwa.

Umthombo ovela lbisworld

Ulwazi olubekwe ngenhla luhlinzekwa yi-lbisworld ngaphandle kwe-Chovm.com. I-Chovm.com ayenzi izethulo namawaranti mayelana nekhwalithi nokuthembeka komdayisi nemikhiqizo.

বাংলা

বাংলা Nederlands

Nederlands English

English Français

Français Deutsch

Deutsch हिन्दी

हिन्दी Bahasa Indonesia

Bahasa Indonesia Italiano

Italiano 日本語

日本語 한국어

한국어 Bahasa Melayu

Bahasa Melayu മലയാളം

മലയാളം پښتو

پښتو فارسی

فارسی Polski

Polski Português

Português Русский

Русский Español

Español Kiswahili

Kiswahili ไทย

ไทย Türkçe

Türkçe اردو

اردو Tiếng Việt

Tiếng Việt isiXhosa

isiXhosa Zulu

Zulu